PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on April 11, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified in Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ |

No fee required. |

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Dear Fellow Stockholders:

It is my pleasure to invite you to the 2025 Annual Meeting of Stockholders of Omega Healthcare Investors, Inc., which will be held on Friday, June 6, 2025 at 10:00 AM EDT.

Enclosed you will find a notice setting forth the items we expect to address during the meeting and our Proxy Statement. The Proxy Statement and our Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, are available electronically at www.proxyvote.com or www.omegahealthcare.com and are first being sent to our stockholders on or about April 22, 2025.

Your vote is important to us. Even if you do not plan to attend the meeting, we hope your votes will be represented. Included in the Annual Report is our 2025 letter to stockholders in which we discuss the progress we’ve made on our strategy, lay out our financial performance and explain how our people navigated a dynamic market environment to achieve our results.

I would like to personally thank you for your continued support of Omega Healthcare Investors as we continue to invest together in the future of this company. We look forward to engaging with our stockholders at our Annual Meeting.

|

|

|

|

C. Taylor Pickett Chief Executive Officer April 22, 2025

303 International Circle

|

Notice of 2025 Annual Meeting of Stockholders

|

The Annual Meeting will be held: FRIDAY, JUNE 6, 2025 It will be held virtually via live webcast at: virtualshareholdermeeting.com/ |

|

Proposals: 1: Election of eight members to Omega’s Board of Directors 2: Ratification of the selection of Ernst & Young LLP as our independent auditor for fiscal year 2025 3: Advisory vote on executive compensation 4. Approval of the Amendment to our Charter to increase the number of authorized shares of our common stock. We may also transact any other business as may properly come before the meeting or any adjournment or postponement thereof. Director Nominees: |

||

Kapila K. Anand |

Craig R. Callen |

Dr. Lisa C. Egbuonu-Davis |

||

Barbara B. Hill |

Kevin J. Jacobs |

C. Taylor Pickett |

||

Stephen D. Plavin |

Burke W. Whitman |

|||

|

Each of the director nominees presently serves as a director of Omega. Attendance: Our Board of Directors has fixed the close of business on April 9, 2025 as the record date for the determination of stockholders who are entitled to notice of and to vote at our Annual Meeting or any adjournments or postponements thereof. On or about April 22, 2025, we will first send to our stockholders our 2025 Proxy Statement and Annual Report to Stockholders for fiscal year 2024. This year, we are again adopting a virtual format for our Annual Meeting. For further information on how to participate in the Annual Meeting via live webcast, please consult the section captioned “Quorum and Voting” on page 63 of this Proxy Statement. |

||||

Your Vote is Important:

Whether or not you plan to virtually attend the meeting, please vote promptly using one of the below methods to ensure that your shares are properly voted. If you hold shares through a broker, bank or other nominee (in “street name”), you may receive a separate voting instruction form, or you may need to contact your broker, bank or other nominee to determine whether you will be able to vote electronically using the Internet or telephone.

|

Scan this QR code to be directed to www.proxyvote.com |

Call toll-free |

Complete, sign, date and return your proxy card in the enclosed envelope |

Virtually attend the Annual Meeting and vote your shares |

|||

By order of Omega’s Board of Directors,

C. Taylor Pickett

April 22, 2025

Hunt Valley, Maryland

Table of Contents

28 |

||||||

1 |

Proposal 4 - Amendment to Our Charter to Increase the Number of |

|||||

7 |

29 |

|||||

7 |

29 |

|||||

7 |

29 |

|||||

8 |

29 |

|||||

12 |

30 |

|||||

14 |

30 |

|||||

14 |

30 |

|||||

15 |

31 |

|||||

15 |

31 |

|||||

15 |

31 |

|||||

16 |

32 |

|||||

17 |

Section 4 - Summary of Executive Compensation Program and Governance Practices |

34 |

||||

19 |

Section 5 - Components of Our Executive Compensation Program |

38 |

||||

22 |

40 |

|||||

22 |

46 |

|||||

22 |

47 |

|||||

23 |

48 |

|||||

23 |

49 |

|||||

23 |

49 |

|||||

24 |

50 |

|||||

24 |

52 |

|||||

24 |

54 |

|||||

24 |

54 |

|||||

24 |

55 |

|||||

Proposal 2 - Proposal to Ratify the Selection of Ernst & Young LLP as our |

56 |

|||||

25 |

58 |

|||||

25 |

58 |

|||||

25 |

60 |

|||||

26 |

62 |

|||||

26 |

62 |

|||||

27 |

63 |

|||||

27 |

63 |

|||||

27 |

65 |

|||||

27 |

65 |

|||||

28 |

65 |

|||||

28 |

66 |

|||||

28 |

67 |

|||||

28 |

67 |

|||||

28 |

||||||

Forward-Looking Statements

Unless otherwise indicated or except where the context otherwise requires, the terms “Company,” “we,” and “our” refer to Omega Healthcare Investors, Inc. and its consolidated subsidiaries. This Proxy Statement includes website addresses and references to additional materials found on those websites. These websites and materials are not incorporated into this Proxy Statement by reference.

Statements in this proxy statement that are not historical facts are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as well as the Private Securities Litigation Reform Act of 1995, including statements regarding our environmental and social goals, commitments, and strategies. Forward-looking statements include, among other things, statements relate to our expectations, beliefs, intentions, plans, objectives, goals, strategies, future events, performance and underlying assumptions and other statements other than statements of historical facts statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “may,” “will,” “anticipates,” “expects,” “believes,” “intends,” “should” or comparable terms or the negative thereof. This document includes forward-looking statements within the meaning of. These statements involve risks and uncertainties.

Actual results could differ materially from any future results expressed or implied by the forward-looking statements for a variety of reasons, including due to the risks and uncertainties that are discussed in our most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. These statements are based on information available on the date of this filing and only speak as to the date hereof and no obligation to update such forward-looking statements should be assumed We assume no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement and does not contain all of the information you should consider. Please read the entire Proxy Statement carefully before voting.

Annual Meeting Logistics

|

|

|

||

|

WHEN June 6, 2025 at 10:00 am EDT |

WEBCAST virtualshareholdermeeting.com/OHI2025 |

RECORD DATE April 9, 2025 |

Voting Guide

|

PROPOSAL 1 |

Election of eight Directors The Board of Directors recommends that you vote FOR each director nominee. These individuals bring a range of relevant experiences and overall diversity of perspectives that is essential to good governance and leadership of our company. |

OUR BOARD RECOMMENDS A VOTE FOR EACH DIRECTOR NOMINEE |

|

PROPOSAL 2 |

Ratification of the selection of Ernst & Young LLP as our independent auditor for fiscal year 2025 The Board of Directors recommends that you vote FOR the ratification of Ernst & Young LLP (“EY”). We believe EY has sufficient knowledge and experience to provide our company with a wide range of accounting services that are on par with the best offered in the industry. |

OUR BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL |

|

PROPOSAL 3 |

Advisory Approval of the Company’s Executive Compensation (“Say-on-Pay”) The Board of Directors recommends that you vote FOR the “say-on-pay” advisory proposal because our compensation program attracts top talent commensurate with our peers and reinforces our “Pay for Performance” philosophy. |

OUR BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL |

|

PROPOSAL 4 |

Amendment to OUR Charter to Increase the Number of Authorized Shares of our Common Stock The Board of Directors recommends you vote FOR the Charter amendment proposal to increase our authorized shares of our common stock. We believe that the availability of additional shares is essential for Omega to successfully pursue its investment strategy and will also enhance Omega’s flexibility in connection with general corporate purposes, such as equity offerings and acquisitions or mergers. |

OUR BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL |

Director Election (Page 8) Our Board of Directors currently consists of eight directors.

Our Nominating and Corporate Governance Committee of the Board of Directors has nominated Craig R. Callen, Kapila K. Anand, Dr. Lisa C. Egbuonu-Davis, Barbara B. Hill, Kevin J. Jacobs, C. Taylor Pickett, Stephen D. Plavin, and Burke W. Whitman for re-election as directors. Each of the nominees for re-election is an incumbent director. Unless authority to vote for the election of directors has been specifically withheld, the persons named in the accompanying proxy card intend to vote FOR the election of the nominees named above to hold office until the 2026 Annual Meeting or until their respective successors have been duly elected and qualified.

If any nominee becomes unavailable for any reason (which event is not anticipated), the shares represented by the enclosed proxy may (unless the proxy contains instructions to the contrary) be voted for such other person or persons as may be determined by the holders of the proxies.

Below we included selected information regarding each of our eight director nominees for election at the 2025 Annual Meeting.

Name and Principal Occupation |

Age |

Director Since |

Other Public Company Boards |

Committee Memberships |

||||

Audit |

Compensation |

Investment |

Nominating & Corporate Governance |

|||||

Craig R. Callen |

|

69 |

2013 |

|

|

|

||

Kapila K. Anand |

71 |

2018 |

1 |

|

|

|||

Dr. Lisa C. Egbuonu-Davis |

67 |

2021 |

2 |

|

|

|||

|

Barbara B. Hill NexPhase Capital |

72 |

2013 |

1 |

|

|

|||

|

Kevin J. Jacobs Hilton Worldwide Holdings Inc. |

52 |

2020 |

|

|

||||

|

C. Taylor Pickett Omega Healthcare Investors, Inc. |

63 |

2002 |

1 |

|

||||

|

Stephen D. Plavin Blackstone Group |

65 |

2000 |

|

|

||||

|

Burke W. Whitman Colmar Holdings LLC |

69 |

2018 |

1 |

|

|

|||

Number of meetings in 2024 |

4 |

4 |

6 |

4 |

||||

|

|

Director Diversity (Page 17)

Below we have included selected information regarding the diversity and skills of our directors, with further explanation included on pages 17 to 18.

Age |

Tenure |

Gender |

|

|

|

Director Skills and Experience (Page 18) Below we have included selected information regarding the experience of our directors, with further explanation included on page 18.

of 8 nominees |

|||||||||

leadership |

8 |

||||||||

accounting |

6 |

||||||||

Real estate |

6 |

||||||||

Health care |

6 |

||||||||

sitting executive |

3 |

||||||||

investment |

7 |

||||||||

CYBER |

4 |

||||||||

Corporate Sustainability |

5 |

||||||||

LEGAL/REGULATORY |

5 |

||||||||

HUMAN CAPITAL |

7 |

||||||||

3 |

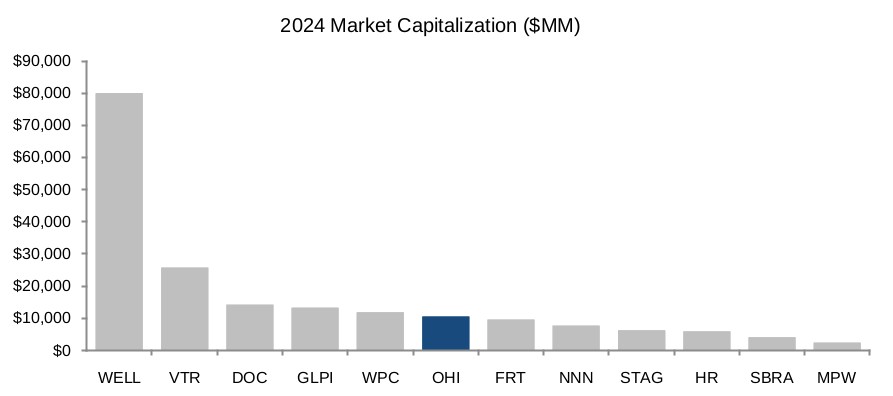

Financial Performance Highlights (Page 31)

Below we have included selected financial performance highlights for the Company as of December 31, 2024.

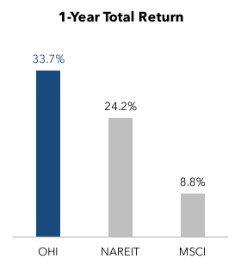

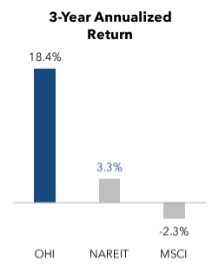

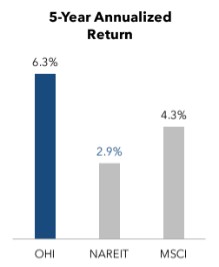

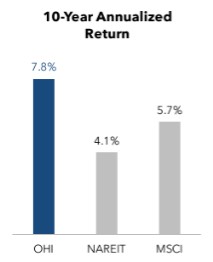

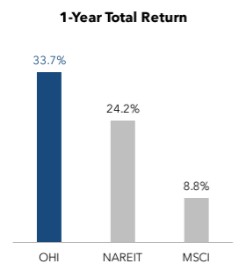

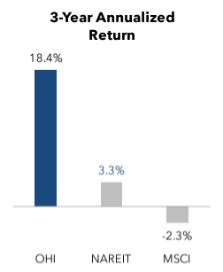

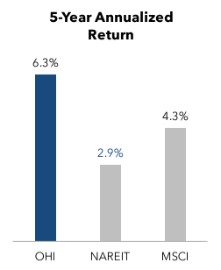

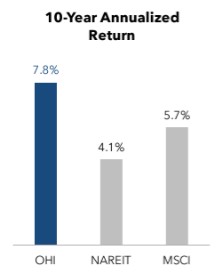

| ✓ | We outperformed the FTSE Nareit Equity Health Care Index and MSCI US REIT Index on a 1-, 3-, 5-, and 10-year basis based on our 2024 year-end total shareholder return, as shown below. |

TOTAL SHAREHOLDER RETURN (“Absolute TSR”) ANNUALIZED PERFORMANCE FOR PERIODS ENDED DECEMBER 31, 2024, Relative to indices | |||

|

|

|

|

OHI = Omega Healthcare Investors, Inc. | |||

Absolute TSR figures above are per S&P Global and are calculated using stock/index prices at the beginning and end of the stated period, assuming the reinvestment of dividends.

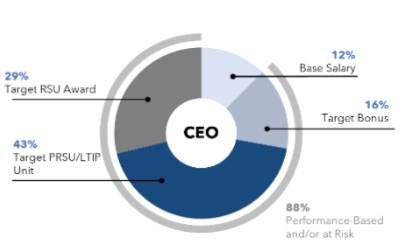

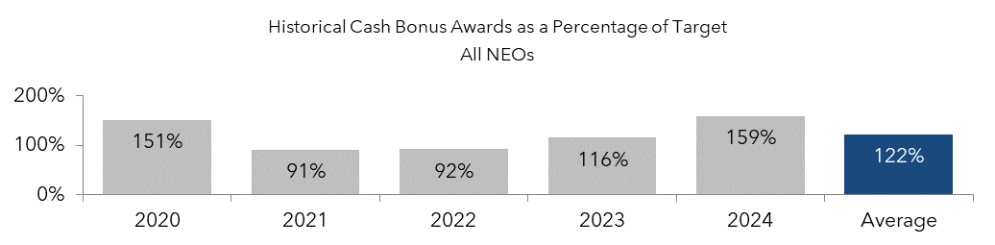

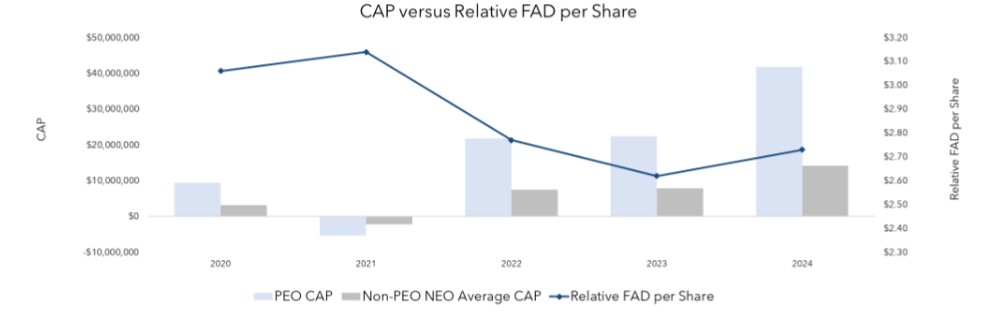

Executive Compensation Highlights (Page 38)

Below we have included selected executive compensation highlights for the Company for fiscal year 2024(1).

|

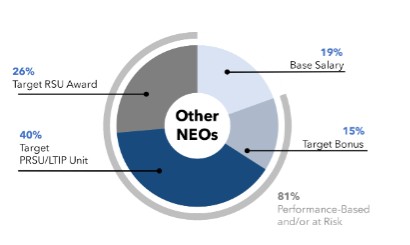

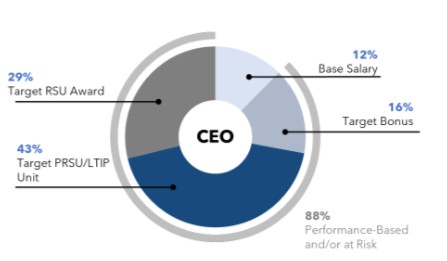

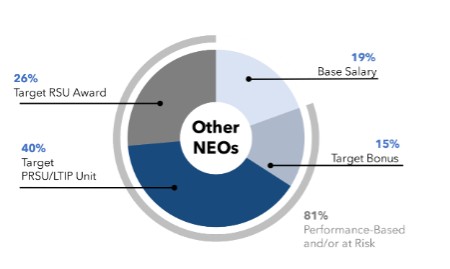

ceo target compensation mix |

avg. other neos target compensation mix |

|

|

| (1) | Includes 2024 target compensation for Mr. Booth, including a target annual cash bonus, although he was not eligible to receive the annual cash bonus due to the termination of his employment effective January 2, 2025. |

4 |

Summary of compensation program

Base |

●

Fixed level of cash compensation to attract and retain key executives in a competitive marketplace

●

Preserves an executive’s commitment during downturns

|

●

Determined based on evaluation of individual executives, compensation, internal pay equity and a comparison to the peer group

|

||||

|

||||||

Annual |

●

Target cash incentive opportunity (set as a percentage of base salary) to encourage achievement of annual Company financial and operational goals

●

Assists in attracting, retaining and motivating executives in the near term

|

●

Majority (70% for 2024) of incentive opportunity based on objective performance measures, which includes Funds Available for Distribution (“FAD”) per Share, Tenant Quality and Leverage

●

A portion (30% for 2024) of the payout is also based on performance against individual-specific subjective goals

|

||||

|

||||||

Long-Term |

●

Focuses executives on achievement of long-term financial and strategic goals and Absolute TSR and TSR relative to an index of healthcare peer REITs (“Relative TSR”), thereby creating long-term stockholder value

●

Assists in maintaining a stable, continuous management team in a competitive market

●

Maintains stockholder management alignment

●

Easy to understand and track performance

●

Limits dilution to existing stockholders relative to utilizing stock options

|

RSUs and Profits Interest Units (Time-based) |

●

40% of target annual long-term incentive awards in 2024

●

Provides upside incentive in up-market, with some down-market protection; supports retention

●

Three-year cliff vest (subject to certain exceptions)

|

|||

|

PRSUs and Profits Interest Units (Performance-based) |

●

60% of target annual long-term incentive award in 2024, requiring significant outperformance to achieve target

●

Three-year performance periods with the actual payout based on Absolute TSR (45%) and Relative TSR performance (55%)

●

Provides some upside in up-or down-market based on relative performance

●

Direct alignment with stockholders

●

Additional vesting once earned (25% per calendar quarter, subject to certain exceptions) for enhanced retention

|

|||||

|

SAY-ON-PAY At our 2024 annual meeting of stockholders, holders of approximately 94.5% of the votes cast on such proposal approved the advisory vote (“say-on-pay”) on the 2023 compensation of our named executive officers (referred herein as our “NEOs”), which was consistent with the level of support we received in 2023 and 2022 on our “say-on-pay” proposal and continued a long-term trend of significant shareholder support of 93% or higher in each of the last nine years. The Committee considered the results of the advisory vote when setting executive compensation for 2025 and plans to continue to do so in future executive compensation policies and decisions. |

|

||

|

CLAWBACK POLICY Our Board voluntarily adopted a formal clawback policy in 2019 that applies to incentive compensation and in 2023 adopted a revised policy consistent with Securities and Exchange Commission (“SEC”) and New York Stock Exchange (“NYSE”) requirements for clawback policies. |

|||

5 |

Governance Highlights (Page 34)

Below we have included selected governance highlights of the Company.

|

accountability ●

Annual Election of Directors. Our Board consists of a single class of directors who stand for election each year.

●

Proxy Access. Our Bylaws grant stockholders meeting certain eligibility requirements the right to nominate director candidates and require us to include in our proxy materials for an annual meeting stockholder-nominated director candidates up to the greater of two director seats or 20% of the Board.

●

Board Evaluations. Our directors undergo annual evaluations of the Board as a whole and each director individually.

●

Annual Say-on-Pay. We annually submit “say-on-pay” advisory votes for our stockholders’ consideration and vote.

independence ●

Chair and CEO Roles Separated. Our independent Chair of the Board provides independent leadership for our Board.

●

Executive Sessions of Our Board. An executive session of independent directors is generally held at each regularly scheduled Board and Committee meeting.

●

7/8 directors are independent. All of the members of the Board of Directors meet the NYSE listing standards for independence, other than our CEO, Mr. Pickett. Each of the members of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee meets the NYSE listing standards for independence.

|

compensation practices ●

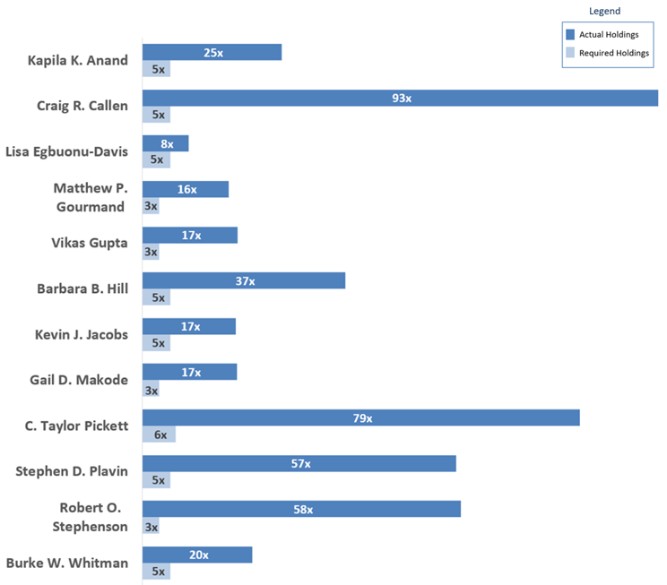

Stock Ownership Guidelines. We have stock ownership guidelines for our senior officers and our non-employee directors.

●

Anti-Hedging and Anti-Pledging. Our directors, officers and employees are subject to anti-hedging and anti-pledging policies.

risk management ●

Enterprise Risk Management. Our Board reviews the Company’s risks and enterprise risk management processes, and our Audit Committee reviews the Company’s policies with respect to risk assessment and risk management, at least annually.

●

Cybersecurity Training. We provide cybersecurity training to our directors, officers and employees at least annually.

●

Portfolio & Investment Risk Management. We manage portfolio and investment risk by, among other things, seeking Investment Committee and/or Board approval for new investments over designated thresholds and providing detailed underwriting information on such proposed investments to the Investment Committee or the Board, as the case may be.

Corporate Sustainability oversight ●

Corporate Sustainability Website. In 2024, we updated our corporate sustainability website that launched in 2021, www.omegahealthcare.com/sustainability.

●

Compliance. Also in 2024, we continued implementing mandatory compliance training for our Board members and employees.

|

6 |

Proposal 1 – Election of Directors

|

Vote Required for Election Each director will be elected by the majority of the votes cast. A “majority of the votes cast” means that the number of the votes cast “FOR” a director exceeds the number of votes “AGAINST.” Abstentions and broker non-votes, if any, will have no effect on the outcome of the election of directors. Your broker may not vote your shares in the election of directors unless you have specifically directed your broker how to vote your shares. As a result, we urge you to instruct your broker how to vote your shares. |

The Board of Directors unanimously recommends a vote FOR the election of each of the director nominees identified below. |

7 |

Director Nominees

Our Board of Directors currently consists of eight directors.

Our Nominating and Corporate Governance Committee of the Board of Directors has nominated Craig R. Callen, Kapila K. Anand, Dr. Lisa C. Egbuonu-Davis, Barbara B. Hill, Kevin J. Jacobs, C. Taylor Pickett, Stephen D. Plavin and Burke W. Whitman for re-election as directors. Each of the nominees for re-election is an incumbent director. Unless authority to vote for the election of directors has been specifically withheld, the persons named in the accompanying proxy card intend to vote FOR the election of the nominees named above to hold office until the 2026 Annual Meeting or until their respective successors have been duly elected and qualified.

If any nominee becomes unavailable for any reason (which event is not anticipated), the shares represented by the enclosed proxy may (unless the proxy contains instructions to the contrary) be voted for such other person or persons as may be determined by the holders of the proxies. Information about each director nominee is set forth below.

Craig R. Callen |

||||||

|

INDEPENDENT AGE: 69 DIRECTOR SINCE: 2013 |

business experience Mr. Callen was a Senior Advisor at Crestview Partners, a private equity firm, from 2009 through 2016. Previously, Mr. Callen retired as Senior Vice President of Strategic Planning and Business Development for Aetna Inc., where he also served as a Member of the Executive Committee from 2004-2007. In his role at Aetna, Mr. Callen reported directly to the chairman and CEO and was responsible for oversight and development of Aetna’s corporate strategy, including mergers and acquisitions. Prior to joining Aetna in 2004, Mr. Callen was a Managing Director and Head of U.S. Healthcare Investment Banking at Credit Suisse and co-head of Health Care Investment Banking at Donaldson Lufkin & Jenrette. During his 20-year career as an investment banker in the healthcare practice Mr. Callen successfully completed over 100 transactions for clients and contributed as an advisor to the boards of directors and management teams of many of the leading healthcare companies in the U.S. In April 2024, Mr. Callen became an independent director and Chair of the Audit Committee for North Haven Net REIT, a newly formed private REIT focused on investing in primarily net lease commercial real estate assets. Mr. Callen has served on the boards of Symbion, Inc. (short-stay surgery facilities), a Crestview portfolio company; Sunrise Senior Living, Inc. (NYSE:SRZ); Kinetic Concepts, Inc. (NYSE:KCI) (a medical technology company); and HMS Holdings Corp. (NYSE:HSMY). Mr. Callen serves as a Trustee of The Richard Hampton Jenrette Foundation. |

|||||

|

expertise Mr. Callen brings to the Board financial and operating experience as an advisor, investment banker and board member in the healthcare industry. |

OTHER PUBLIC BOARDS ●

Sunrise Senior Living, Inc. (NYSE:SRZ) (1999-2006)

●

Kinetic Concepts, Inc. (NYSE:KCI) (2008-2011)

●

HMS Holdings Corp. (NYSE:HSMY) (2013-2021)

|

|||||

Kapila K. Anand |

||||||

|

INDEPENDENT AGE: 71 DIRECTOR SINCE: 2018 |

business experience Ms. Anand served as an audit and later advisory partner at KPMG LLP (“KPMG”) from 1989 until her retirement in March 2016, after which she was retained as a senior advisor to KPMG until 2020. Ms. Anand joined KPMG LLP in 1979 and served in a variety of roles, including the National Partner-in-Charge, Public Policy Business Initiatives (from 2008 to 2013) and segment leader for the Travel, Leisure, and Hospitality industry and member of the Global Real Estate Steering Committee (each from 2013 to 2016). In these roles she was involved in numerous risk and governance projects including IT general controls. Ms. Anand has served on KPMG LLP boards in the U.S. and Americas, the board of the Franciscan Ministries (an organization with a range of real estate assets, including schools, churches and hospitals) and as the chair of both the KPMG Foundation as well as the Chicago Network (a membership organization of senior executives). She also previously served as the Global Lead Director for the Women Corporate Directors Education and Development Foundation and served on the board of the U.S. Fund for UNICEF, and currently serves on a variety of non-profit boards, including Rush University Medical Center. Ms. Anand served as a director of Extended Stay America, Inc. (NASDAQ:STAY) from July 2016 through its sale in June 2021, and during that time she chaired the Compensation Committee and also served as a director and Audit Committee Chairwoman of ESH Hospitality, Inc. (a real estate investment trust (“REIT”) subsidiary of Extended Stay America) from May 2017 through June 2021. In September 2018, she joined the Board of Elanco Animal Health, Inc. (NYSE:ELAN), where she chairs the Audit Committee and serves on the Nominating and Governance Committee. She is a Certified Public Accountant, who in 2022 earned the Diligent Climate Leadership certification and in 2023 earned the NACD Cyber Risk Oversight certification. |

|||||

|

expertise Ms. Anand brings to the board extensive experience in accounting and auditing, particularly in the real estate industry, with a focus on REITs, and healthcare industries. |

OTHER PUBLIC BOARDS ●

Elanco Animal Health, Inc. (NYSE:ELAN) (2018-present)

●

Extended Stay America, Inc. (NASDAQ:STAY) (2016-2021)

●

ESH Hospitality, Inc. (a REIT subsidiary of Extended Stay America) (2017-2021)

|

|||||

8 |

Dr. Lisa C. Egbuonu-Davis |

|||||

|

INDEPENDENT AGE: 67 DIRECTOR SINCE: 2021 |

business experience From 2019 to 2023, Dr. Egbuonu-Davis served as Vice President, Medical Innovations for DH Diagnostics, LLC, an affiliate of Danaher Corporation (NYSE:DHR), where she provided medical advice to influence research, partnership and investment strategy across Danaher’s diagnostic platform businesses. Also, during this period, she served at various times as Interim Chief Medical Officer for certain subsidiaries of Danaher Corporation. From 2015 to 2019, she served as Vice President, Global Patient Centered Outcomes and Solutions at Sanofi, Inc. (NASDAQ:SNY). At Sanofi, Dr. Egbuonu-Davis created patient programs, services and tools to enhance adherence and health outcomes in patients with chronic conditions. Prior to Sanofi, Dr. Egbuonu-Davis co-founded and served as director for ROI Squared, LLC, a privately held life science company focused on diagnostic medical devices, and served as managing director for LED Enterprise, LLC, where she advised biopharmaceutical companies and trade associations on health care reform, technology assessment, quality metrics and incentives and implications for research and services. She also served in senior advisor roles for Avalere Health and Booz Allen Hamilton. She previously served for 13 years in various roles at Pfizer, Inc. (NYSE:PFE), where she led clinical and outcomes research departments, supported product value assessments in support of reimbursement and adoption and influenced product investment and development decisions. Dr. Egbuonu-Davis currently serves on the Johns Hopkins Medicine Board of Trustees and the National Advisory Council for the Johns Hopkins University School of Education. In March 2023, she joined the Board of Avanos Medical, Inc. (NYSE:AVNS), a medical device company where she serves as a member of the governance committee and chair of the compliance committee. In 2023, she joined the Board of Phreesia, Inc. (NYSE: PHR), a publicly traded medical software company focusing on patient intake, payment processing and patient activation, where she serves on the governance committee. |

||||

|

expertise Dr. Egbuonu-Davis brings to the Board broad strategic and operational experience in pharmaceuticals, public health and consulting, including expertise in the development and implementation of research, commercialization, and investment strategies, for a variety of patient populations in addition to her medical and public health expertise. |

OTHER PUBLIC BOARDS ●

Avanos Medical, Inc. (NYSE:AVNS) (2023-present)

●

Phreesia, Inc. (NYSE:PHR) (2023-present)

|

||||

Barbara B. Hill |

|||||

|

INDEPENDENT AGE: 72 DIRECTOR SINCE: 2013 |

business experience Ms. Hill is currently an Operating Partner of NexPhase Capital (formerly Moelis Capital Partners), a private equity firm, where she focuses on healthcare-related investments and providing strategic and operating support for NexPhase's healthcare portfolio companies. She began as an Operating Partner of Moelis Capital Partners in March 2011. From March 2006 to September 2010, Ms. Hill served as Chief Executive Officer and a director of ValueOptions, Inc., a managed behavioral health company, and FHC Health Systems, Inc., its parent company. Prior to that, from August 2004 to March 2006, she served as Chairman and Chief Executive Officer of Woodhaven Health Services, an institutional pharmacy company. In addition, from 2002 to 2003, Ms. Hill served as President and a director of Express Scripts, Inc. (NASDAQ:ESRX), a pharmacy benefits management company. In previous positions, Ms. Hill was responsible for operations nationally for Cigna HealthCare and also served as the CEO of health plans owned by Prudential, Aetna and the Johns Hopkins Health System. She was also active with the boards or committees of the Association of Health Insurance Plans and other health insurance industry groups. Since 2013, she has served as a board member of Integra LifeSciences Holdings Corporation (NASDAQ:IART), a medical device and technology company, where she is lead director. She previously served as a board member of Owens & Minor (NYSE:OMI), a healthcare distribution company, from 2017 to August 2019; St. Jude Medical Corporation, a medical device company, from 2007 to January 2017, until its sale to Abbott Labs, and Revera Inc., a Canadian company operating over 500 senior facilities throughout Canada, Great Britain and the U.S., from 2010 to March 2017. |

||||

|

expertise Ms. Hill brings to the Board years of experience in operating and serving as a director of healthcare-related companies.

|

OTHER PUBLIC BOARDS ●

Integra LifeSciences Holdings Corporation (NASDAQ:IART) (2013–present)

●

Owens & Minor, Inc. (NYSE:OMI) (2017-2019)

|

||||

9 |

Kevin J. Jacobs |

|||||

|

INDEPENDENT AGE: 52 DIRECTOR SINCE: 2020 |

business experience Mr. Jacobs is Chief Financial Officer and President, Global Development for Hilton Worldwide Holdings, Inc. (“Hilton”) (NYSE:HLT), and leads the company's finance, real estate, development and architecture and construction functions globally. Mr. Jacobs joined the company in 2008 as Senior Vice President, Corporate Strategy; was elected Treasurer in 2009; was appointed Executive Vice President & Chief of Staff in 2012; assumed the role of Chief Financial Officer in 2013; and added the role of President, Global Development in 2020. Prior to Hilton, Mr. Jacobs was Senior Vice President, Mergers & Acquisitions and Treasurer of Fairmont Raffles Hotels International. Prior to Fairmont Raffles, Mr. Jacobs spent seven years with Host Hotels & Resorts, ultimately serving as Vice President, Corporate Strategy & Investor Relations. Prior to Host, Mr. Jacobs had various roles in the Hospitality Consulting Practice of Pricewaterhouse Coopers (“PwC”) and the Hospitality Valuation Group of Cushman & Wakefield. He is also a Trustee of Cornell University and a member of the Dean’s Advisory Board of the Cornell University School of Hotel Administration; is Chair of the Board of Directors of Goodwill of Greater Washington. He also serves as the Immediate Past Chair and an Executive Board Member of the American Hotel & Lodging Association. |

||||

|

expertise Mr. Jacobs brings to the Board significant experience managing both private and public companies in the hospitality and real estate industries, including REITs; knowledge of financial reporting and other regulatory matters; and significant capital markets, real estate investment and management/operational experience. | |||||

C. TAYLOR PICKETT |

|||||

|

NON-INDEPENDENT AGE: 63 DIRECTOR SINCE: 2002 |

business experience Mr. Pickett has served as Chief Executive Officer of the Company since 2001 and as Director of the Company since May 2002. Mr. Pickett has also served as a member of the board of trustees of COPT Defense Properties (NYSE:CDP), an office REIT focusing on U.S. government agencies and defense contractors, since November 2013. In this capacity, Mr. Pickett acts as Chair of the Compensation Committee and is a member of the Investment Committee. From 1998 to June 2001, Mr. Pickett served as Executive Vice President and Chief Financial Officer of Integrated Health Services, Inc. (NYSE:IHS). From 1993 to 1998, Mr. Picket served as a member of the senior management team of IHS in a variety of positions. Prior to joining IHS, Mr. Pickett held various positions at PHH Corporation and KPMG Peat Marwick. |

||||

|

expertise As Chief Executive Officer of the Company, Mr. Pickett brings to the Board a depth of understanding of our business and operations, as well as financial expertise in long-term healthcare services, mergers and acquisitions. |

OTHER PUBLIC BOARDS ●

COPT Defense Properties (NYSE:CDP) (2013–present)

|

||||

10 |

STEPHEN D. PLAVIN |

||||||

|

INDEPENDENT AGE: 65 DIRECTOR SINCE: 2000 |

business experience Since December 2012, Mr. Plavin has been a Senior Managing Director of the Blackstone Group. Mr. Plavin currently oversees Blackstone’s commercial real estate lending and debt investing activities in Europe. Previously, from when he joined Blackstone until June 2021, Mr. Plavin was the Chief Executive Officer and a Director of Blackstone Mortgage Trust, Inc. (NYSE:BXMT), an NYSE- listed commercial mortgage REIT that is managed by Blackstone. Prior to joining Blackstone, Mr. Plavin served as CEO of Capital Trust, Inc. (predecessor of Blackstone Mortgage Trust), since 2009. From 1998 until 2009, Mr. Plavin was Chief Operating Officer of Capital Trust and was responsible for all of the lending, investing and portfolio management activities of Capital Trust, Inc. Prior to that time, Mr. Plavin was employed for 14 years with Chase Manhattan Bank and its securities affiliate, Chase Securities Inc. Mr. Plavin held various positions within the real estate finance unit of Chase, and its predecessor, Chemical Bank, and in 1997 he became co-head of global real estate for Chase. From 2009 until its sale in 2017, Mr. Plavin was also the Non-executive Chairman of the Board of Directors of WCI Communities, Inc. (post 2013 IPO, NYSE: WCIC), a developer of residential communities. WCI was purchased by Lennar Corporation (NYSE:LEN and LEN.B) in February 2017. |

|||||

|

expertise Mr. Plavin brings to the Board management experience in the commercial real estate lending, banking and mortgage REIT sectors, experience in capital market transactions, and experience as a public company CEO along with significant related oversight experience. |

OTHER PUBLIC BOARDS ●

Capital Trust, Inc. (NYSE:CT) (2009-2013)

●

Blackstone Mortgage Trust (NYSE:BXMT) (2013-2021)

●

WCI Communities, Inc. (post-2013 IPO, NYSE:WCIC) (2013-2017)

|

|||||

BURKE W. WHITMAN |

||||||

|

INDEPENDENT AGE: 69 DIRECTOR SINCE: 2018 |

business experience Since 2019, Mr. Whitman has served as CEO of Colmar Holdings LLC (a private company) and member of the Board of Directors of Amicus Therapeutics, Inc. (NASDAQ:FOLD) (Audit & Compliance Committee; Nominating & Governance Committee). Previously Mr. Whitman served in business and the military concurrently. In the military, he served as an infantry, recon, and general officer of the U.S. Marine Corps from 1985 to 2019, including 14 years on active duty during which he commanded at every level, led multiple combat deployments, and served as a commanding general. In business, he served as CEO, Board Director and initially COO of Health Management Associates, Inc. (then NYSE:HMA) from 2005 to 2008; CFO of Triad Hospitals, Inc. (then NYSE:TRI) from 1998 to 2005; and President and Board Director of Deerfield Healthcare (then a private company) from 1994 to 1998. He serves on the Boards of Directors of the Marine Corps Heritage Foundation (Vice Chair) and Buckhead Coalition (Executive Committee), and on the corporation board of Nashotah Theological Seminary; previously, he served on the Boards of Directors of the Toys for Tots Foundation (Chair, Investment Committee) and Federation of American Hospitals (Chair, Audit Committee), the Board of Trustees of the Lovett School (now a lifetime trustee), and the Reserve Forces Policy Board (advisor to the US Secretary of Defense).

|

|||||

|

expertise Mr. Whitman brings to the Board corporate and military leadership experience, including executive and financial leadership in the healthcare sector. |

OTHER PUBLIC BOARDS ●

Amicus Therapeutics, Inc. (NASDAQ:FOLD) (2019-present)

●

Health Management Associates, Inc. (NYSE:HMA) (2005–2008)

|

|||||

11 |

Stock Ownership Information

The following table sets forth information regarding the beneficial ownership of our common stock as of April 9, 2025 for:

| ● | each of our directors and the executive officers appearing in the table under “Executive Compensation Tables and Related Information, Summary Compensation Table” included elsewhere in this Proxy Statement; and |

| ● | all persons known to us to be the beneficial owner of more than 5% of our outstanding common stock. |

Beneficial ownership of our common stock, for purposes of this Proxy Statement, includes shares of our common stock as to which a person has voting and/or investment power, or the right to acquire such power within 60 days of April 9, 2025. Except for shares of restricted stock and unvested units as to which the holder does not have investment power until vesting or as otherwise indicated in the footnotes, the persons named in the table have sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by them, subject to community property laws where applicable. The “Common Stock Beneficially Owned” columns do not include unvested time-based restricted stock units (“RSUs”), unvested performance-based restricted stock units (“PRSUs”) and deferred stock units under our Deferred Compensation Plan (except to the extent such units vest or the applicable deferral period expires within 60 days of April 9, 2025) or common stock issuable in respect of operating partnership units (“OP Units”) or profits interests in OHI Healthcare Properties Limited Partnership (“Omega OP”). Accordingly, we have provided supplemental information regarding deferred stock units, unvested RSUs, OP Units and earned but not yet vested PRSUs and profits interests in Omega OP (“Profits Interest Units”) under the caption “Other Common Stock Equivalents.” For information regarding unearned, unvested PRSUs and Profits Interest Units for performance periods not yet completed, see “Outstanding Equity Awards at Fiscal Year End” below.

The business address of the directors and executive officers is 303 International Circle, Suite 200, Hunt Valley, Maryland 21030. As of April 9, 2025, there were 287,147,508 shares of common stock outstanding and no preferred stock outstanding, as well as 10,959,315 common stock equivalents (including OP Units) outstanding, as defined in the table below.

Common Stock |

|||||||||||||||

Beneficially Owned |

Other Common Stock Equivalents |

|

|||||||||||||

Operating |

Percent of Class |

|

|||||||||||||

Number |

Percentage |

Unvested |

Vested Profits |

Deferred |

Partnership |

Including Common |

|

||||||||

Beneficial Owner |

|

of Shares |

|

of Class |

|

Units(1) |

|

Interest Units(2) |

|

Stock Units(3) |

|

Units(4) |

|

Stock Equivalents(5) |

|

Kapila K. Anand |

14,676 |

* |

— |

— |

35,599 |

— |

* |

||||||||

Daniel J. Booth (6) |

128,685 |

* |

291,548 |

— |

— |

403,010 |

0.3% |

||||||||

Craig R. Callen |

59,162 |

* |

— |

— |

64,427 |

63,047 |

0.1% |

||||||||

Dr. Lisa C. Egbuonu-Davis |

16,766 |

(7) |

* |

— |

— |

— |

— |

* |

|||||||

Barbara B. Hill |

31,310 |

* |

— |

— |

— |

41,994 |

* |

||||||||

Kevin J. Jacobs |

33,696 |

(8) |

* |

— |

— |

— |

— |

* |

|||||||

Gail D. Makode |

1,142 |

* |

114,763 |

— |

— |

117,610 |

0.1% |

||||||||

C. Taylor Pickett |

4,100 |

* |

572,046 |

— |

575,539 |

888,588 |

(9) |

0.7% |

|||||||

Stephen D. Plavin |

94,753 |

(10) |

* |

— |

— |

— |

18,791 |

* |

|||||||

Robert O. Stephenson |

183,076 |

* |

238,994 |

— |

— |

492,432 |

0.3% |

||||||||

Burke W. Whitman |

39,765 |

(7) |

* |

— |

— |

— |

— |

* |

|||||||

Directors, director nominee and current executive officers as a group (11 persons) |

607,131 |

0.2% |

1,217,351 |

— |

675,565 |

2,025,472 |

1.5% |

||||||||

5% Beneficial Owners: (11) |

|

|

|

|

|

|

|

||||||||

BlackRock, Inc. |

34,524,557 |

(12) |

12.0% |

11.6% |

|||||||||||

Cohen & Steers, Inc. |

26,659,292 |

(13) |

9.3% |

— |

— |

— |

8.9% |

||||||||

* Less than 0.10%

| (1) | Includes RSUs and earned but unvested PRSUs and Profits Interest Units that in each case vest more than 60 days from April 9, 2025, subject to continued employment. RSUs and time-based Profits Interest Units held by executive officers are subject to additional vesting in connection with a Qualifying Termination or Retirement. Earned but not yet vested PRSUs and performance-based Profits Interest Units held by the executive officers vest quarterly in the year following the end of the applicable performance period subject to continued employment, except in the case of a Qualifying Termination, Retirement or change in control in which case they are also subject to vesting. Each unit represents the right to receive one share of common stock. See “Outstanding Equity Awards at Fiscal Year End.” Unvested Profits Interest Units held by the directors other than Mr. Pickett vest upon completion of the current one-year term, subject to accelerated vesting in connection with death, disability of change in control. |

| (2) | Includes earned but unvested Profits Interest Units that are scheduled to vest within 60 days from April 9, 2025, subject to continued service, but which can be converted to OP units if certain tax-related conditions are met. |

| (3) | Deferred stock units representing the deferral of vested equity awards pursuant to the Company’s Deferred Stock Plan. Includes deferred stock units associated with RSUs and PRSUs vesting within 60 days which the holder has elected to defer. The deferred stock units will not be converted until the date or event specified in the applicable deferred stock agreement. See “Nonqualified Deferred Compensation.” |

12 |

| (4) | OP Units are redeemable at the election of the holder for cash equal to the value of one share of our common stock priced at the average closing price for the 10-day trading period ending on the date of the holder’s notice of election to redeem the OP Units, subject to the Company’s right to apply an administrative charge of up to 1% of the cash amount otherwise payable upon a redemption, as well as the Company’s election to exchange the OP Units tendered for redemption for shares of Omega common stock on a one-for-one basis, in each case subject to adjustment. |

| (5) | Percent of class reflects 287,147,508 shares of common stock outstanding as of April 9, 2025, plus a total of 10,959,315 common stock equivalents, consisting of 1,684,850 unvested RSUs and Profits Interest Units, 675,565 deferred stock units, approximately 8,598,900 OP Units. |

| (6) | Mr. Booth’s employment terminated effective January 2, 2025. |

| (7) | Includes 4,605 shares of restricted stock, subject to forfeiture until vested. |

| (8) | Includes 7,522 shares of restricted stock, subject to forfeiture until vested. |

| (9) | Excludes 225,000 OP Units that Mr. Pickett gifted an irrevocable trust for the benefit of his spouse and son on September 3, 2021, over which Mr. Pickett has no voting power. |

| (10) | Includes 34,306 shares of common stock that are held by a limited liability company, of which Mr. Plavin is the manager. |

| (11) | Except as otherwise indicated below, information regarding 5% beneficial owners is based on information reported on Schedule 13G filings by the beneficial owners indicated with respect to the common stock of Omega. |

| (12) | Based on a Schedule 13G/A filed with the SEC on February 5, 2025 by BlackRock, Inc., including on behalf of certain subsidiaries. BlackRock, Inc. is located at 50 Hudson Yards, New York, NY 10001. BlackRock, Inc. has sole voting power with respect to 32,722,487 of the shares and sole dispositive power with respect to 34,524,557 of the shares. |

| (13) | Based on a Schedule 13G/A filed with the SEC on February 13, 2025, by Cohen & Steers, Inc., including on behalf of certain subsidiaries. Cohen & Steers, Inc. is located at 1166 Avenue of the Americas, 30th Floor, New York City, New York, 10036. Cohen & Steers, Inc. has sole voting power with respect to 20,243,012 of the shares and sole dispositive power with respect to 26,659,292 of the shares. |

13 |

Board Committees and Corporate Governance

Board of Directors and Committees of the Board

The members of the Board of Directors on the date of this Proxy Statement and the Committees of the Board on which they serve are identified below.

|

Name |

Committee Memberships |

||||||||

Audit |

Compensation |

Investment |

Nominating & |

||||||

|

Craig R. Callen |

|

|

|

|||||

|

Kapila K. Anand |

|

|

||||||

|

Dr. Lisa C. Egbuonu-Davis |

|

|

||||||

|

Barbara B. Hill |

|

|

||||||

|

Kevin J. Jacobs |

|

|

||||||

|

C. Taylor Pickett |

|

|||||||

|

Stephen D. Plavin |

|

|

||||||

|

Burke W. Whitman |

|

|

||||||

Number of meetings in 2024 |

4 |

4 |

6 |

4 |

|||||

|

|

|

|

14 |

The Board of Directors held six meetings during 2024. Each member of the Board of Directors attended more than 75% of the meetings of the Board of Directors and of the committees of which such director was a member in 2024. In 2024, we amended our Corporate Governance Guidelines to require our directors to use reasonable efforts to participate in our annual meeting of stockholders. Mr. Pickett chaired Omega’s 2024 annual meeting of stockholders, and a total of six members of our Board of Directors participated virtually in our 2024 annual meeting of stockholders.

Director Independence

All of the members of the Board of Directors meet the NYSE listing standards for independence, other than our Chief Executive Officer, Mr. Pickett. While the Board of Directors has not adopted any categorical standards of independence, in making these independence determinations, the Board of Directors noted that no director other than Mr. Pickett (a) received direct compensation from our Company other than director annual retainers and meeting fees, (b) had any relationship with our Company or a third party that would preclude independence or (c) had any material business relationship with our Company and its management, other than as a director of our Company. Each of the members of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee meets the NYSE listing standards for independence.

Board Leadership Structure

Since 2001, an independent non-employee director has served as our Chair of the Board of Directors rather than the Chief Executive Officer. We separate the roles of Chief Executive Officer and Chair of the Board in recognition of the difference between the two roles. At this time, the Board believes this leadership structure is appropriate, as it allows the Chief Executive Officer to focus on implementing the strategic direction for the Company as approved by the Board of Directors and the management of the day-to-day operations of the Company, while the Chair of the Board provides guidance to the Chief Executive Officer and sets the agenda for and presides over meetings of the Board. Mr. Callen, as Chair of the Board, presides over any meeting, including regularly scheduled executive sessions of the non-employee directors. If Mr. Callen is not present at such a session, the presiding director is chosen by a vote of those present at the session.

Risk Oversight

The Board of Directors, as a whole and at the committee level, plays an important role in overseeing the management of risk. Management is responsible for identifying the significant risks facing the Company, implementing risk management strategies that are appropriate for the Company’s business and risk profile, integrating consideration of risk and risk management into the Company’s decision-making process and communicating information with respect to material risks to the Board or the appropriate committee.

Portfolio and investment risk is one of the principal risks faced by the Company. We manage portfolio and investment risk by, among other things, seeking Investment Committee and/or Board approval for new investments over designated thresholds and providing detailed underwriting information on such proposed investments to the Investment Committee or the Board, as the case may be. In addition, our full Board regularly reviews the performance, credit information and coverage ratios of our operators.

Consistent with the rules of the NYSE, the Audit Committee reviews and discusses with management, periodically, as appropriate, but not less than annually, policies with respect to risk assessment and risk management, the Company’s financial risk exposures and the steps management has taken to monitor and control such exposures, it being understood that it is the job of management to assess and manage the Company’s exposure to risk and that the Audit Committee’s responsibility is to discuss guidelines and policies by which risk assessment and risk management are undertaken. The Audit Committee also monitors the implementation and administration of the Company’s Code of Business Conduct and Ethics and disclosure controls.

Our Board and management exercise oversight over the Company’s enterprise-wide strategy, policy, standards, architecture, processes and risk assessment related to information security and data protection, including data privacy and network standards (our “Cybersecurity Program”), which represents an important component of the Company’s overall approach to enterprise risk management. Omega’s Vice President of Information Technology (“VP of IT”) manages a team responsible for leading our Cybersecurity Program. The VP of IT reports directly to the Company’s Chief Financial Officer and provides periodic reporting on our Cybersecurity Program to our senior management team, our Board and the Audit Committee.

As part of our Cybersecurity Program, the Company deploys technical safeguards that are designed to protect our information systems from cybersecurity threats, which are evaluated and improved through vulnerability assessments and cybersecurity threat intelligence. Our Cybersecurity Program also includes an annual risk assessment which is generally based on frameworks established by the National Institute of Standards and Technology, as well as policies and procedures designed to identify and mitigate cybersecurity threats related to our use of material third-party vendors.

15 |

We maintain and regularly test the effectiveness of our Information Security Incident Response Plan governing prevention, detection, mitigation and remediation of cybersecurity incidents and threats, as well as our controls and procedures that provide for the prompt escalation of certain cybersecurity incidents, with appropriate involvement by our Board.

Our Board, in coordination with our Audit Committee, oversees our management of cybersecurity risk, with the Audit Committee reviewing and discussing with management quarterly matters related to our Cybersecurity Program as it relates to financial reporting. The Board and Audit Committee receive periodic reports about the prevention, detection, mitigation and remediation of cybersecurity incidents, including material security risks and information security vulnerabilities. Additionally, risks associated with the Cybersecurity Program are integrated into the Company’s enterprise risk management assessment and reported to our Board at least twice per year. We obtain periodic assessments by third party experts to assess our vulnerability management and security controls and to assist us in identifying and mitigating security risks, and we share the key results with our Board and Audit Committee. We also provide cybersecurity training for all directors, officers and employees at least annually and periodic additional training of senior management through our cyber insurance carrier.

The Compensation Committee reviews risks associated with the Company’s compensation plans and arrangements. The Nominating and Corporate Governance Committee reviews risks associated with the Company's corporate sustainability program. While each committee monitors certain risks and the management of such risks, the full Board is regularly informed about such matters. The full Board generally oversees enterprise risk management and enterprise risk management issues otherwise arising in the Company’s business and operations. In 2025, the Company formed an AI Committee to oversee management of risks related to artificial intelligence, which are now included in enterprise risk management reporting to the Board.

|

|||||||||||

Areas of Oversight |

|

Audit |

|

Compensation |

|

Nominating & |

|

Investment |

|

Full |

|

|

Corporate Strategy |

● |

|||||||||

|

Portfolio Management |

● |

|||||||||

|

Enterprise Risk Management |

● |

|||||||||

|

Privacy and Data Security |

● |

|||||||||

|

Code of Business Conduct & Ethics |

● |

● |

||||||||

|

Board and Executive Compensation |

● |

● |

||||||||

|

Corporate Sustainability |

● |

● |

||||||||

|

Board and Executive Succession |

● |

● |

||||||||

|

Investment Activity |

● |

● |

||||||||

Standing Committee Information

The Audit Committee met four times in 2024. Its primary function is to assist the Board of Directors in fulfilling its oversight responsibilities with respect to: (i) the financial information to be provided to stockholders and the SEC; (ii) the system of internal controls that management has established and (iii) the external independent audit process. In addition, the Audit Committee selects Omega’s independent auditors and provides an avenue for communication between the independent auditors, financial management and the Board of Directors. The responsibilities of the Audit Committee are more fully described in its Charter, which is available on our website at www.omegahealthcare.com.

16 |

Each of the members of the Audit Committee is independent and financially literate, as required of audit committee members by the NYSE. The Board of Directors has determined that Ms. Anand, Mr. Jacobs and Mr. Whitman each qualify as an “audit committee financial expert” as such term is defined in Item 401(h) of Regulation S-K promulgated by the SEC. The Board of Directors has determined that (i) Ms. Anand qualifies as an audit committee financial expert based on her substantial experience in accounting and auditing as a partner of KPMG and as a public company audit committee member, (ii) Mr. Whitman qualifies as an audit committee financial expert based on his substantial financial management experience in the healthcare sector, including as a public company chief financial officer and chief executive officer, and (iii) Mr. Jacobs qualifies as an audit committee financial expert based on his substantial financial management experience, including as a public company chief financial officer.

The Compensation Committee has responsibility for determining the compensation of our executive officers and administering our equity incentive plan. During 2024, the Compensation Committee met four times. The responsibilities of the Compensation Committee are more fully described in its Charter, which is available on our website at www.omegahealthcare.com.

The Investment Committee works with management to develop strategies for growing our portfolio and has authority to approve investments up to established thresholds. The Investment Committee met six times during 2024. The responsibilities of the Investment Committee are more fully described in its Charter.

The Nominating and Corporate Governance Committee met four times during 2024. The Nominating and Governance Committee has responsibility for identifying potential nominees to the Board of Directors and reviewing their qualifications and experience, for developing and implementing policies and practices relating to corporate governance, and for overseeing the Company’s progress on corporate sustainability and human resources initiatives. The responsibilities of the Nominating and Corporate Governance Committee are more fully described in its charter, which is available on our website at www.omegahealthcare.com.

In addition to the standing Committees listed above, the Board has established a Special Administrative Committee under the Company’s equity incentive plan consisting solely of Mr. Pickett, with the authority to allocate and grant awards thereunder to employees of Omega and its affiliates who are not executive officers of Omega up to a maximum number of units or shares authorized by the Compensation Committee from time to time. In addition, the Board has formed, and may from time to time form, such other committees as it deems appropriate to fulfill its responsibilities, including to execute capital markets and other activity.

Identification of Director Nominees and Board Diversity

The process for identifying and evaluating nominees to the Board is initiated by identifying candidates who meet the criteria for selection as a nominee and have the specific qualities or skills being sought based on input from members of the Board of Directors and, if the Nominating and Corporate Governance Committee deems appropriate, a third-party search firm. Nominees for director are selected based on their depth and breadth of experience, industry experience, financial background, integrity, ability to make independent analytical inquiries and willingness to devote adequate time to director duties, among other criteria.

In addition, the Nominating and Corporate Governance Committee endeavors to identify nominees that possess diverse educational backgrounds, business experiences and life skills, as well as diverse gender, racial, sexual orientation, national origin and ethnic characteristics.

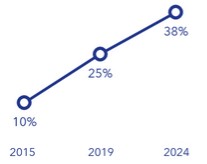

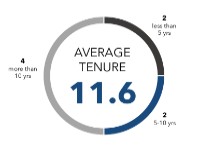

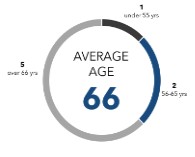

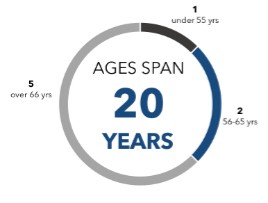

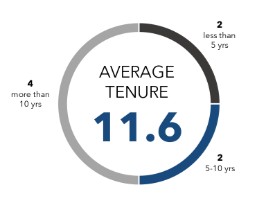

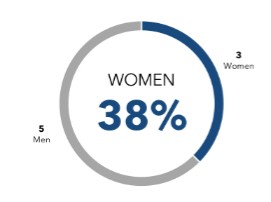

OVERALL |

GENDER |

TENURE |

AGE |

||

|

3 Women

|

38% |

|

|

|

|

38% of our Board nominees are women, and two nominees bring racial diversity to our Board. Also, the director nominees range in age from 52 to 72 with the average age being 66. Four of our Board members were first elected to our Board in or after 2018. The Nominating and Corporate Governance Committee does not assign specific weight to any particular criteria; the goal is to identify nominees that, considered as a group, will possess an effective mix of backgrounds, talents, knowledge, skill sets and characteristics necessary for the Board of Directors to fulfill its responsibilities.

17 |

The table below provides a summary of certain of these collective competencies and attributes of the Board nominees. The lack of an indicator for a particular nominee does not mean that the director does not possess that skill or experience, as we look to each director to be knowledgeable in all of these areas. Rather, the indicator represents that the item is a core competency that the director brings to the Board.

Summary of Board Skills | |||||||||||

Anand |

Callen |

Egbuonu-Davis |

Hill |

Jacobs |

Pickett |

Plavin |

Whitman |

Total |

Percentage (1) |

||

Skills / Experience |

Leadership |

● |

● |

● |

● |

● |

● |

● |

● |

8 |

100% |

Accounting |

● |

● |

● |

● |

● |

● |

6 |

75% |

|||

Real Estate |

● |

● |

● |

● |

● |

● |

6 |

75% |

|||

Health Care |

● |

● |

● |

● |

● |

● |

6 |

75% |

|||

Sitting Executive |

● |

● |

● |

3 |

38% |

||||||

Investment |

● |

● |

● |

● |

● |

● |

● |

7 |

88% |

||

Cybersecurity |

● |

● |

● |

● |

4 |

50% |

|||||

Corporate Sustainability |

● |

● |

● |

● |

● |

5 |

63% |

||||

Legal/Regulatory |

● |

● |

● |

● |

● |

5 |

63% |

||||

Human Capital Management |

● |

● |

● |

● |

● |

● |

● |

7 |

88% |

||

Attributes |

Racial Diversity: |

||||||||||

African American |

● |

1 |

13% |

||||||||

Asian/Pacific Islander |

● |

1 |

13% |

||||||||

White/Caucasian |

● |

● |

● |

● |

● |

● |

6 |

75% |

|||

Hispanic/Latino |

|||||||||||

Native American |

|||||||||||

Other |

|||||||||||

Gender Diversity: |

|||||||||||

Male |

● |

● |

● |

● |

● |

5 |

63% |

||||

Female |

● |

● |

● |

3 |

38% |

||||||

Other |

|||||||||||

Independence: |

|||||||||||

Independent Director |

● |

● |

● |

● |

● |

● |

● |

7 |

88% |

||

Non-Independent Director |

● |

1 |

13% |

||||||||

Military Status: |

|||||||||||

Veteran |

● |

1 |

13% |

||||||||

Non-Veteran |

● |

● |

● |

● |

● |

● |

● |

7 |

88% |

||

| (1) | Percentages have been rounded to the closest whole number. |

Our directors have a wide range of additional skills and experience not mentioned above, which they bring to their roles as directors to Omega’s benefit, including experience in the financial services industry, corporate governance and nonprofit leadership areas. The term “Sitting Executive” above refers to a director’s current position in an executive role for a publicly-traded company or its subsidiary. Racial and gender diversity attributes are based on self-identified attributes of our directors. Expertise in cybersecurity, corporate sustainability, legal/regulatory and human capital management reflect a director’s belief that they have overseen or otherwise developed expertise in such areas. Our directors’ skills and experience are further described in their biographies above. The Nominating and Corporate Governance Committee will consider written proposals from stockholders for nominees as director. Any such nomination should be submitted to the Nominating and Corporate Governance Committee through our Secretary in accordance with the procedures and time frames described in our Bylaws.

18 |

Corporate Sustainability Oversight

In connection with internal assessments and stockholder engagement, we prioritize corporate sustainability initiatives that matter most to our business and stockholders. Our Nominating and Corporate Governance Committee has been charged with oversight of the Company’s corporate sustainability responsibility (“CSR”) efforts; however, CSR remains the responsibility and focus of our entire Board. In 2020, we published our first Corporate Sustainability Report, and in 2021 we launched our CSR website, which is available through our website. We updated our CSR website in 2024.

CSR focus areas | ||||

|

|

|

||

Environmental |

Social Responsibility |

Governance |

||

|

●

Efficient Corporate Headquarters with Carbon Neutrality Achieved in 2024 for Scope 1 and Scope 2 Emissions

●

Supporting Green Strategies in Tenant Programs

●

CSR Website and Report

|

●

Equal Opportunity and an Open and Inclusive Culture

●

Employee Development and Growth

●

Supporting Community Involvement

|

●

Separate CEO and Chair

●

Proactively Adopted Proxy Access

●

Strong Alignment of Pay for Performance

|

||

|

ENVIRONMENTAL RESPONSIBILITY |

We place a high priority on the protection of our assets, communities and the environment. Based on our business model, the properties in our portfolio are primarily net leased to our tenants, and each tenant is generally responsible for maintaining the buildings, including controlling their energy usage and the implementation of environmentally sustainable practices at each location. We support our tenants’ operations and work with them to promote environmental responsibility at the properties we own and to reiterate the importance of energy efficient facilities, including by:

| ● | providing capital to our operators to add or upgrade to energy-efficient emergency power generators to limit disruption to patient care in the event of a power outage; |

| ● | supporting compliance with prevailing environmental laws and regulations throughout our new development, major renovation and capital expenditure projects; |

| ● | promoting the adoption of specific environmental practices in our sustainable and innovative new developments, including, but not limited to, the installation of occupancy sensors and water-efficient plumbing fixtures, the use of low VOC paints and adhesives and the use of energy-efficient lighting, with 60% of Omega’s development from 2015 to 2024 having been built to Leadership in Energy and Environmental Design (“LEED”) certification standards; and |

| ● | recognizing the environmental impact associated with our controlled operations, we are actively taking steps to neutralize our carbon footprint in our corporate headquarters. While we occupy a modest office space for our corporate headquarters, in 2021, we announced our commitment to carbon neutrality for Scope 1 and Scope 2 emissions by 2023. In 2023, we achieved this standard by purchasing carbon offsets. Our decision to purchase carbon offset credits reflects our dedication to sustainable business practices. By investing in carbon offset credits, we are not only offsetting unavoidable emissions but also contributing to impactful environmental projects that align with our commitment to sustainability. We purchase and validate carbon offset credits through a third-party, Lune, which certified in 2024 that 181t CO2 were retired on behalf of Omega via carbon offset projects, which fully offset the prior year’s carbon footprint in our corporate headquarters. The occupied space of our corporate headquarters was approximately 33,100 square feet in 2023. |

19 |

|

Corporate HQ LEED Certified Our focus on environmental responsibility is also demonstrated by how we manage our day-to-day activities at our corporate headquarters, which has earned the LEED Silver Certification in Existing Buildings: Operations & Maintenance, and where we also promote energy efficiency with features such as an automatic lighting control system, water efficient features, low-VOC paints and floor adhesives and a single-stream recycling service. |

60% of Omega’s development projects from 2015-2024 built to LEED certification standards |

|

SOCIAL RESPONSIBILITY & EQUAL OPPORTUNITY |

We are committed to providing a positive and engaging work environment for our employees and taking an active role in the betterment of the communities in which our employees live and work. Our employees are provided with a competitive benefits program, including comprehensive healthcare benefits and a 401(k) plan with a matching contribution from the Company, the opportunity to participate in our employee stock purchase program, bonus and incentive pay opportunities, competitive paid time-off benefits and paid parental leave, wellness programs, continuing education and development opportunities and periodic engagement surveys. In addition, we believe that giving back to our community is an extension of our mission to improve the lives of our stockholders, our employees and our employees’ families, and we have implemented community engagement events, internship and mentorship programs, as well as a matching program for charitable contributions of employees.

OMEGA’S SOCIAL RESPONSIBILITY Commitments

Omega has a long-standing commitment to being an equal opportunity employer and has implemented Equal Employer Opportunity policies. We regularly conduct pay equity reviews as we seek for women and men, on average, at various roles and levels of the Company, to be paid equitably for their roles and contributions to our success. Additionally, in 2020, we reinforced our commitment to an open and inclusive workplace culture consistent with the Society for Human Resource Management’s CEO Action. In addition, beginning in 2020, we implemented several initiatives to further this commitment within our workforce and Board, in our local community and in the industry in which we operate.

We have made commitments to support programs of the National Association of Real Estate Investment Trusts (“Nareit”) programs, which supports charitable and educational organizations and initiatives that will help create a more inclusive REIT and publicly traded real estate industry. Members of management serve on Nareit’s Corporate Governance Council and Real Estate Sustainability Council. In addition, in 2023 Omega committed as a sponsor of Ferguson Centers for Leadership Excellence, a program that supports and empowers students from a variety of backgrounds to earn undergraduate degrees and secure promising careers in real estate and related sectors.

initiatives designed to impact:

|

Workforce and Board Recruitment & Internships |

We have expanded our recruitment practices to reach more diverse candidates for employment and Board positions and have developed an internship program that supports our local community, including underrepresented and underserved communities, as well as development of a talent pipeline for Omega. In addition, the Company implements mandatory compliance training for our Board members and employees. Three of our eight Board nominees are women, two of whom are racial minorities and one of whom is from a historically underrepresented group. As of February 1, 2025, at the executive level, one of the Company’s five executive officers is a woman and two bring ethnic diversity to the team. As of February 1, 2025, on the senior management team, 29% are women and 29% bring ethnic diversity to the team. |

|

|

local community Charitable Partnerships |

We have invested in several local charitable partnerships to improve economic, health and social outcomes in the local Baltimore, Maryland community, with a focus on elderly, historically underserved, and underrepresented communities. |

|

|

industry Talent Management |

We provide grants for operator training programs that focus on development of talent, including from historically underrepresented communities, and have initiated scholarship and mentorship programs with local universities, including underserved and underrepresented populations. |

20 |

|

Corporate Governance |

Omega maintains a commitment to high corporate governance standards. We believe that sound corporate governance strengthens the accountability of our Board and management and promotes the long-term interest of stockholders. The bullets below highlight areas of our governance practices, which should be read in conjunction with the information set forth above and in our Corporate Governance Guidelines available through our website.

BOARD STRUCTURE |

|

Annual Election of Directors. Opt-out of Maryland Law Allowing Staggering the Board without Shareholder Approval. |

|

Majority Voting Standard for Director Elections with Resignation Policy. Chair and CEO Roles Separated. |

STOCKHOLDER RIGHTS |

Proxy Access. |

Stockholder-Requested Special Meetings. Stockholder Amendments to Bylaws. |

||

COMPENSATION PRACTICES |

Stock Ownership Guidelines. We have stock ownership guidelines for our senior officers and our non-employee directors. |

Clawback Policy. Our Board has adopted a formal clawback policy that applies to incentive compensation. |

||

|

Anti-Hedging and Anti-Pledging. Our directors, officers and employees are subject to anti-hedging and anti-pledging policies. |

Annual Say-on-Pay. We annually submit “say-on-pay” advisory votes for our stockholders’ consideration and vote. |

|||

BOARD PRACTICES |

Annual Strategic Review. The Board generally conducts a formal annual review of our corporate strategy. Executive Sessions of Our Board. An executive session of independent directors is generally held at each regularly scheduled Board and Committee meeting. |

Board Evaluations. Our directors undergo annual evaluations of the Board as a whole and each Committee and director individually. The results of the evaluation are reported to the full Board, and implementation of the results is considered in the following year’s evaluation. Regular Succession Planning. A high priority is placed on regular and thoughtful succession planning for our senior management. |

21 |

ethics and risk management |

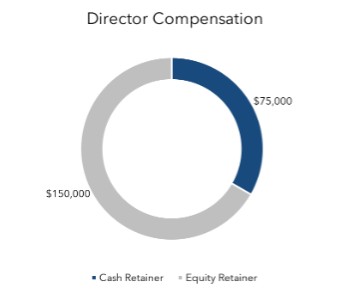

|