425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on March 9, 2015

FILED BY OMEGA HEALTHCARE INVESTORS, INC.

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933

AND DEEMED FILED UNDER

RULE 14A-12

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FILING BY: OMEGA HEALTHCARE INVESTORS, INC. (“OMEGA”)

SUBJECT

COMPANY: AVIV REIT, INC. (“AVIV REIT”)

COMMISSION FILE NO. FOR REGISTRATION STATEMENT ON FORM S-4: 333-201359

Below are excerpts from the Omega Healthcare Investors, Inc. (“Omega”) March 2015 Investor Presentation posted by Omega to their website, www.omegahealthcare.com, on March 6, 2015.

Omega Healthcare Investors Investors Presentation March 2015

2 Forward - looking Statements and Non - GAAP Information This presentation may include projections and other forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Such statements relate to future events and expectations and involve unknown risks and uncertainties . Omega’s actual results or actions may differ materially from those projected in the forward - looking statements . For a summary of the specific risk factors that could cause results to differ materially from those expressed in the forward - looking statements, see Omega’s most recent Annual Report on Form 10 - K and quarterly reports on form 10 - Q filed with the Securities and Exchange Commission . This presentation may contain certain non - GAAP financial information including EBITDA , Adjusted EBITDA, Total Adjusted Debt (aka, Funded Debt), Adjusted FFO, Total Cash Fixed Charges and certain related ratios . A reconciliation of these non - GAAP disclosures is available in the Exhibit to this presentation or on our website under “Non - GAAP Financial Measures” at www . omegahealthcare . com . Other financial information is also available on our website . Information is provided as of December 31 , 2014 , unless specifically stated otherwise . We assume no duty to update or supplement the information provided . Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . In connection with the proposed acquisition of Aviv, on January 5 , 2015 , Omega filed a registration statement on Form S - 4 , as amended with the SEC, which includes the preliminary joint proxy statement/prospectus of Omega and Aviv . The registration statement on Form S - 4 , as amended, contains a preliminary joint proxy statement/prospectus and was declared effective by the SEC on February 25 , 2015 . Omega and Aviv mailed a joint proxy statement/prospectus to their stockholders on or about February 25 , 2015 . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION . Investors and security holders may obtain a free copy of the registration statement and joint proxy statement/prospectus, as well as other documents filed by Omega and Aviv, at the SEC’s website (www . sec . gov) . Those documents, as well as Omega’s other public filings with the SEC, may be obtained without charge at Omega’s website at www . omegahealthcare . com . In addition, copies of the definitive proxy statement/prospectus, as well as Aviv’s other public filings with the SEC, may be obtained without charge at Aviv’s website at www . avivreit . com . Omega, Aviv, their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction . Information regarding Omega’s directors and executive officers is available in its proxy statement for its 2014 annual meeting of stockholders, filed with the SEC by Omega on April 29 , 2014 , and information regarding Aviv’s directors and executive officers is available in its proxy statement for its 2014 annual meeting of stockholders, filed with the SEC by Aviv on April 15 , 2014 . Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the registration statement and the joint proxy statement/prospectus (or will be contained in any amendments or supplements thereto and in other relevant materials to be filed with the SEC, when they become available) . These documents can be obtained free of charge from the sources indicated above .

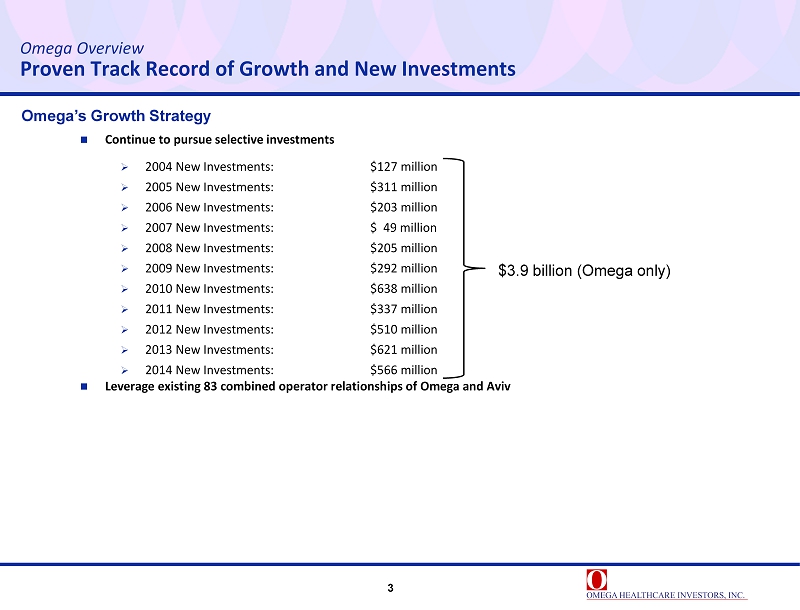

3 Omega Overview Proven Track Record of Growth and New Investments Continue to pursue selective investments » 2004 New Investments : $ 127 million » 2005 New Investments: $311 million » 2006 New Investments: $203 million » 2007 New Investments: $ 49 million » 2008 New Investments: $205 million » 2009 New Investments: $292 million » 2010 New Investments: $ 638 million » 2011 New Investments: $337 million » 2012 New Investments: $510 million » 2013 New Investments: $621 million » 2014 New Investments: $566 million Leverage existing 83 combined operator relationships of Omega and Aviv Omega’s Growth Strategy $3.9 billion (Omega only)

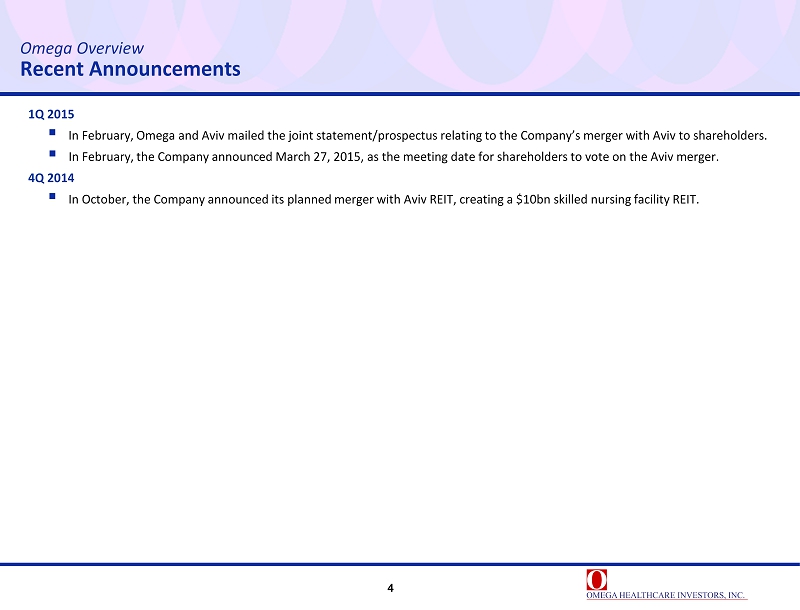

4 Omega Overview Recent Announcements 1Q 2015 ▪ In February, Omega and Aviv mailed the joint statement/prospectus relating to the Company’s merger with Aviv to shareholders. ▪ In February, the Company announced March 27, 2015, as the meeting date for shareholders to vote on the Aviv merger. 4Q 2014 ▪ In October, the Company announced its planned merger with Aviv REIT, creating a $10bn skilled nursing facility REIT.

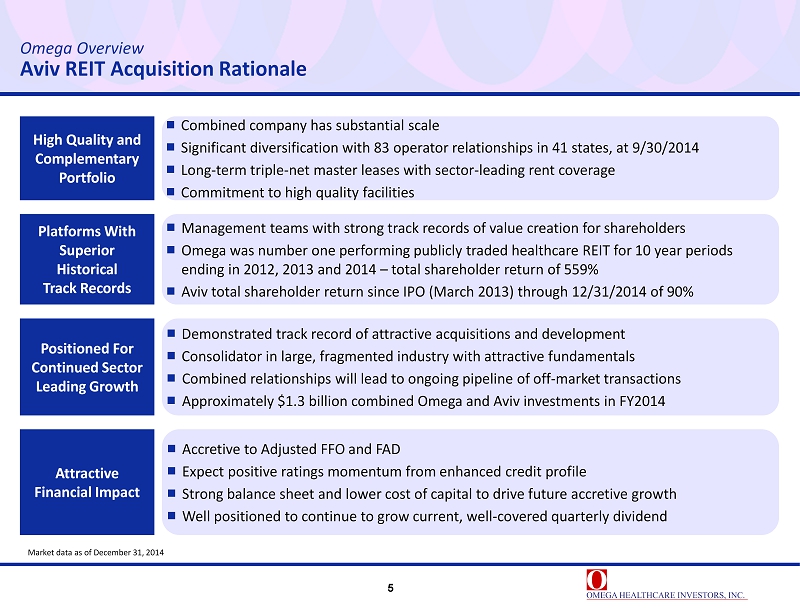

5 Omega Overview Aviv REIT Acquisition Rationale Market data as of December 31, 2014 Positioned For Continued Sector Leading Growth Platforms With Superior Historical Track Records Management teams with strong track records of value creation for shareholders Omega was number one performing publicly traded healthcare REIT for 10 year periods ending in 2012, 2013 and 2014 – total shareholder return of 559% Aviv total shareholder return since IPO (March 2013) through 12/31/2014 of 90% High Quality and Complementary Portfolio Combined company has substantial scale Significant diversification with 83 operator relationships in 41 states, at 9/30/2014 Long - term triple - net master leases with sector - leading rent coverage Commitment to high quality facilities Demonstrated track record of attractive acquisitions and development Consolidator in large, fragmented industry with attractive fundamentals Combined relationships will lead to ongoing pipeline of off - market transactions Approximately $1.3 billion combined Omega and Aviv investments in FY2014 Attractive Financial Impact Accretive to Adjusted FFO and FAD Expect positive ratings momentum from enhanced credit profile Strong balance sheet and lower cost of capital to drive future accretive growth Well positioned to continue to grow current, well - covered quarterly dividend

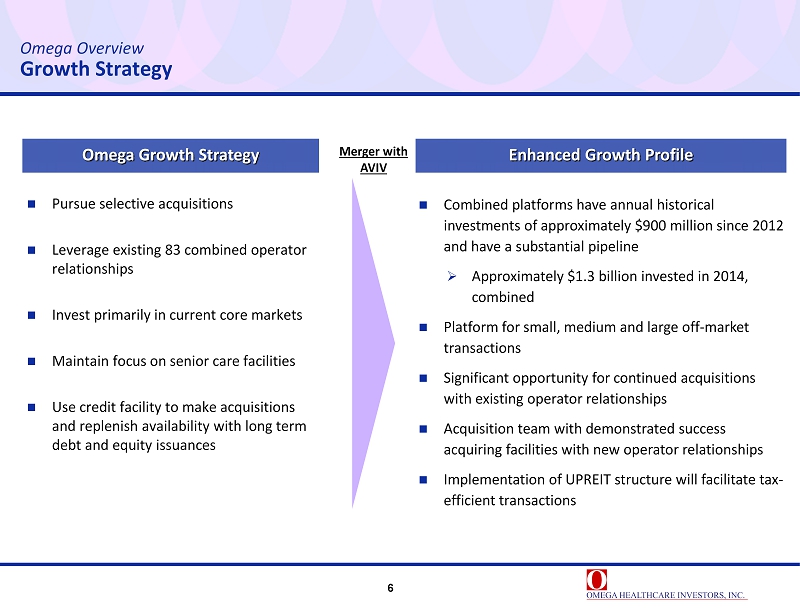

6 Omega Overview Growth Strategy Pursue selective acquisitions Leverage existing 83 combined operator relationships Invest primarily in current core markets Maintain focus on senior care facilities Use credit facility to make acquisitions and replenish availability with long term debt and equity issuances Combined platforms have annual historical investments of approximately $900 million since 2012 and have a substantial pipeline » Approximately $1.3 billion invested in 2014, combined Platform for small, medium and large off - market transactions Significant opportunity for continued acquisitions with existing operator relationships Acquisition team with demonstrated success acquiring facilities with new operator relationships Implementation of UPREIT structure will facilitate tax - efficient transactions Merger with AVIV Omega Growth Strategy Enhanced Growth Profile

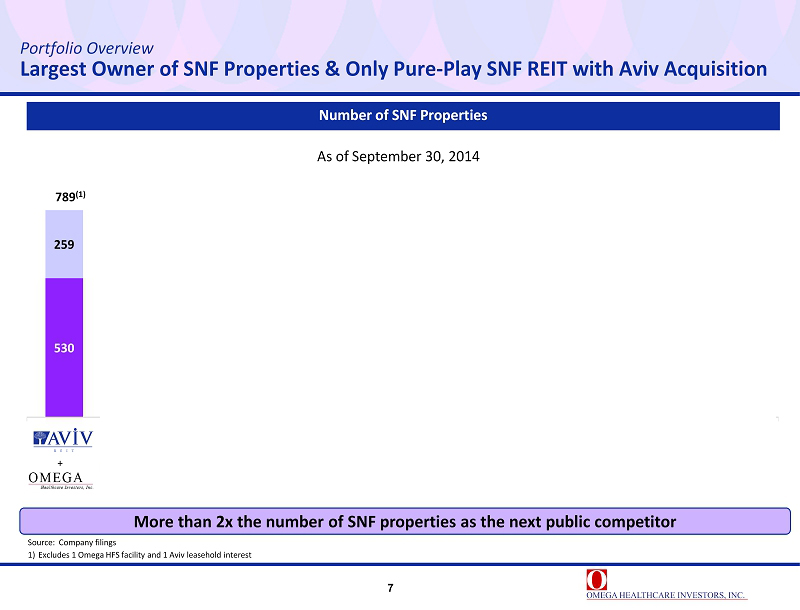

7 Portfolio Overview Largest Owner of SNF Properties & Only Pure - Play SNF REIT with Aviv Acquisition 530 259 789 (1) More than 2x the number of SNF properties as the next public competitor Number of SNF Properties + Source: Company filings 1) Excludes 1 Omega HFS facility and 1 Aviv leasehold interest As of September 30, 2014

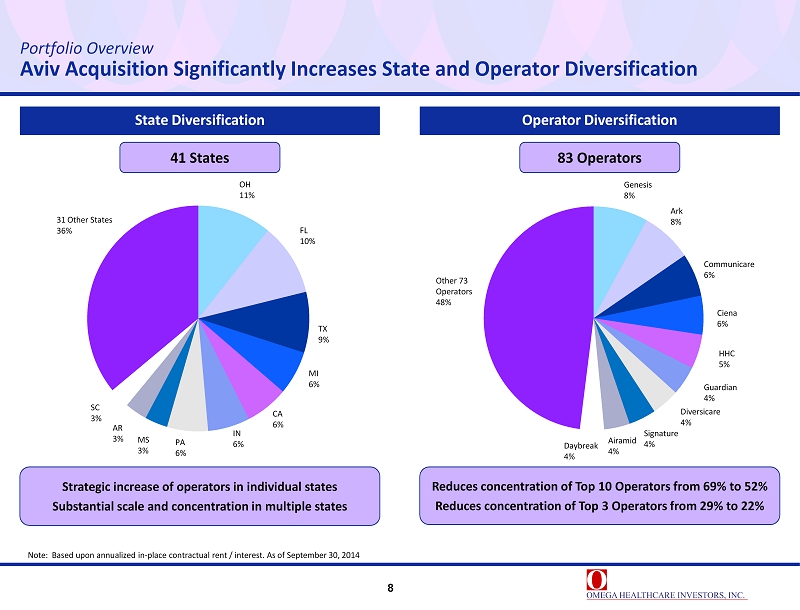

8 Portfolio Overview Aviv Acquisition Significantly Increases State and Operator Diversification Genesis 8% Ark 8% Communicare 6% Ciena 6% HHC 5% Guardian 4% Diversicare 4% Signature 4% Airamid 4% Daybreak 4% Other 73 Operators 48% Operator Diversification Note : Based upon annualized in - place contractual rent / interest. As of September 30, 2014 State Diversification 83 Operators OH 11% FL 10% TX 9% CA 6% MI 6% IN 6% PA 6% MS 3% AR 3% SC 3% 31 Other States 36% Strategic increase of operators in individual states Substantial scale and concentration in multiple states Reduces concentration of Top 10 Operators from 69% to 5 2 % Reduces concentration of Top 3 Operators from 29% to 22% 41 States

9 Financial Overview Growth Strategy Leverage existing 83 combined operator relationships of Omega and Aviv

10 • $1.0B unsecured revolving credit facility » June 2018 maturity, with additional year option » $550MM accordion feature to be exercised simultaneously with the Aviv merger Financial Overview Conservative Capitalization