8-K: Current report filing

Published on December 22, 2015

Exhibit 10.1

[EXECUTION VERSION]

CREDIT AGREEMENT

Dated as of December 16, 2015

among

OMEGA HEALTHCARE INVESTORS, INC.,

as Borrower

CERTAIN SUBSIDIARIES OF THE BORROWER

REFERRED TO HEREIN AS GUARANTORS,

THE LENDERS PARTY HERETO,

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.,

as Administrative Agent,

and

CAPITAL ONE, NATIONAL ASSOCIATION,

as Syndication Agent,

and

UMB Bank, N.A.

and

Regions Bank,

as Co-Documentation Agents

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.

and

CAPITAL ONE, NATIONAL ASSOCIATION,

as Joint Lead Arrangers and Joint Book Runners

TABLE OF CONTENTS

| Page | ||

| Article I DEFINITIONS AND ACCOUNTING TERMS | 1 | |

| 1.01 | Defined Terms | 1 |

| 1.02 | Interpretive Provisions | 32 |

| 1.03 | Accounting Terms | 33 |

| 1.04 | Rounding | 33 |

| 1.05 | References to Agreements and Laws | 34 |

| 1.06 | Times of Day; Rates | 34 |

| Article II COMMITMENTS AND EXTENSION OF CREDITS | 34 | |

| 2.01 | Commitments | 34 |

| 2.02 | Borrowings, Conversions and Continuations | 37 |

| 2.03 | [Reserved] | 38 |

| 2.04 | [Reserved] | 38 |

| 2.05 | Repayment of Loans | 38 |

| 2.06 | Prepayments | 38 |

| 2.07 | [Reserved] | 39 |

| 2.08 | Interest | 39 |

| 2.09 | Fees | 40 |

| 2.10 | Computation of Interest and Fees | 40 |

| 2.11 | Payments Generally | 40 |

| 2.12 | Sharing of Payments | 42 |

| 2.13 | Evidence of Debt | 43 |

| 2.14 | [Reserved] | 43 |

| 2.15 | Defaulting Lenders | 43 |

| Article III TAXES, YIELD PROTECTION AND ILLEGALITY | 45 | |

| 3.01 | Taxes | 45 |

| 3.02 | Illegality | 47 |

| 3.03 | Inability to Determine Rates | 47 |

| 3.04 | Increased Cost and Reduced Return; Capital Adequacy; Reserves on Eurodollar Loans | 48 |

| 3.05 | Funding Losses | 48 |

| 3.06 | Matters Applicable to all Requests for Compensation | 49 |

| 3.07 | Survival | 49 |

| Article IV CONDITIONS PRECEDENT TO EXTENSION OF CREDITS | 49 | |

| 4.01 | Conditions to Initial Extensions of Credit | 50 |

| 4.02 | Conditions to Extensions of Credit | 52 |

| Article V REPRESENTATIONS AND WARRANTIES | 53 | |

| 5.01 | Financial Statements; No Material Adverse Effect | 53 |

| 5.02 | Corporate Existence and Power | 54 |

| 5.03 | Corporate and Governmental Authorization; No Contravention | 54 |

i

| 5.04 | Binding Effect | 54 |

| 5.05 | Litigation | 54 |

| 5.06 | Compliance with ERISA | 55 |

| 5.07 | Environmental Matters | 55 |

| 5.08 | Margin Regulations; Investment Company Act | 56 |

| 5.09 | Compliance with Laws | 57 |

| 5.10 | Ownership of Property; Liens | 57 |

| 5.11 | Corporate Structure; Capital Stock, Etc | 57 |

| 5.12 | Labor Matters | 57 |

| 5.13 | No Default | 57 |

| 5.14 | Solvency | 58 |

| 5.15 | Taxes | 58 |

| 5.16 | REIT Status | 58 |

| 5.17 | Insurance | 58 |

| 5.18 | Intellectual Property; Licenses, Etc | 58 |

| 5.19 | Disclosure | 59 |

| 5.20 | Anti-Terrorism Laws | 59 |

| 5.21 | OFAC | 59 |

| Article VI AFFIRMATIVE COVENANTS | 60 | |

| 6.01 | Financial Statements | 60 |

| 6.02 | Certificates; Other Information | 61 |

| 6.03 | Preservation of Existence and Franchises | 63 |

| 6.04 | Books and Records | 63 |

| 6.05 | Compliance with Law | 63 |

| 6.06 | Payment of Taxes and Other Indebtedness | 63 |

| 6.07 | Insurance | 64 |

| 6.08 | Maintenance of Property | 64 |

| 6.09 | Performance of Obligations | 64 |

| 6.10 | Visits and Inspections | 64 |

| 6.11 | Use of Proceeds/Purpose of Loans | 64 |

| 6.12 | Financial Covenants | 65 |

| 6.13 | Environmental Matters; Preparation of Environmental Reports | 66 |

| 6.14 | REIT Status | 66 |

| 6.15 | Additional Guarantors; Withdrawal or Addition of Unencumbered Properties; Release of Guarantors | 66 |

| 6.16 | Anti-Terrorism Laws | 68 |

| 6.17 | Compliance With Material Contracts | 68 |

| 6.18 | Designation as Senior Debt | 68 |

| 6.19 | Investor Guaranties | 68 |

| Article VII NEGATIVE COVENANTS | 68 | |

| 7.01 | Liens | 69 |

| 7.02 | Indebtedness | 70 |

| 7.03 | Investments | 71 |

| 7.04 | Fundamental Changes | 72 |

| 7.05 | Dispositions | 72 |

ii

| 7.06 | Change in Nature of Business | 73 |

| 7.07 | Transactions with Affiliates and Insiders | 73 |

| 7.08 | Organization Documents; Fiscal Year; Legal Name, State of Formation and Form of Entity | 73 |

| 7.09 | Negative Pledges | 73 |

| 7.10 | Use of Proceeds | 74 |

| 7.11 | Prepayments of Indebtedness | 74 |

| 7.12 | Stock Repurchases | 74 |

| 7.13 | Sanctions | 74 |

| Article VIII EVENTS OF DEFAULT AND REMEDIES | 74 | |

| 8.01 | Events of Default | 74 |

| 8.02 | Remedies Upon Event of Default | 77 |

| 8.03 | Application of Funds | 77 |

| Article IX ADMINISTRATIVE AGENT | 78 | |

| 9.01 | Appointment and Authorization of Administrative Agent | 78 |

| 9.02 | Delegation of Duties | 79 |

| 9.03 | Liability of Administrative Agent | 79 |

| 9.04 | Reliance by Administrative Agent | 79 |

| 9.05 | Notice of Default | 80 |

| 9.06 | Credit Decision; Disclosure of Confidential Information by Administrative Agent | 80 |

| 9.07 | Indemnification of Administrative Agent | 81 |

| 9.08 | Administrative Agent in its Individual Capacity | 81 |

| 9.09 | Successor Administrative Agent | 82 |

| 9.10 | Administrative Agent May File Proofs of Claim | 82 |

| 9.11 | Guaranty Matters | 83 |

| 9.12 | Other Agents; Arrangers and Managers | 83 |

| Article X MISCELLANEOUS | 83 | |

| 10.01 | Amendments, Etc | 83 |

| 10.02 | Notices and Other Communications; Facsimile Copies | 85 |

| 10.03 | No Waiver; Cumulative Remedies | 87 |

| 10.04 | Attorney Costs, Expenses and Taxes | 88 |

| 10.05 | Indemnification | 88 |

| 10.06 | Payments Set Aside | 89 |

| 10.07 | Successors and Assigns | 89 |

| 10.08 | Confidentiality | 93 |

| 10.09 | Set-off | 94 |

| 10.10 | Interest Rate Limitation | 94 |

| 10.11 | Counterparts | 94 |

| 10.12 | Integration | 94 |

| 10.13 | Survival of Representations and Warranties | 95 |

| 10.14 | Severability | 95 |

| 10.15 | Tax Forms | 95 |

| 10.16 | Replacement of Lenders | 97 |

iii

| 10.17 | No Advisory or Fiduciary Responsibility | 98 |

| 10.18 | Source of Funds | 98 |

| 10.19 | GOVERNING LAW | 99 |

| 10.20 | WAIVER OF RIGHT TO TRIAL BY JURY | 99 |

| 10.21 | No Conflict | 100 |

| 10.22 | USA Patriot Act Notice | 100 |

| 10.23 | Electronic Execution of Assignments and Certain Other Documents | 100 |

| 10.24 | Entire Agreement | 100 |

| Article XI GUARANTY | 101 | |

| 11.01 | The Guaranty | 101 |

| 11.02 | Obligations Unconditional | 101 |

| 11.03 | Reinstatement | 103 |

| 11.04 | Certain Waivers | 103 |

| 11.05 | Rights of Contribution | 103 |

| 11.06 | Guaranty of Payment; Continuing Guaranty | 104 |

| 11.07 | Keepwell | 104 |

iv

SCHEDULES

| 2.01 | Lenders and Commitments |

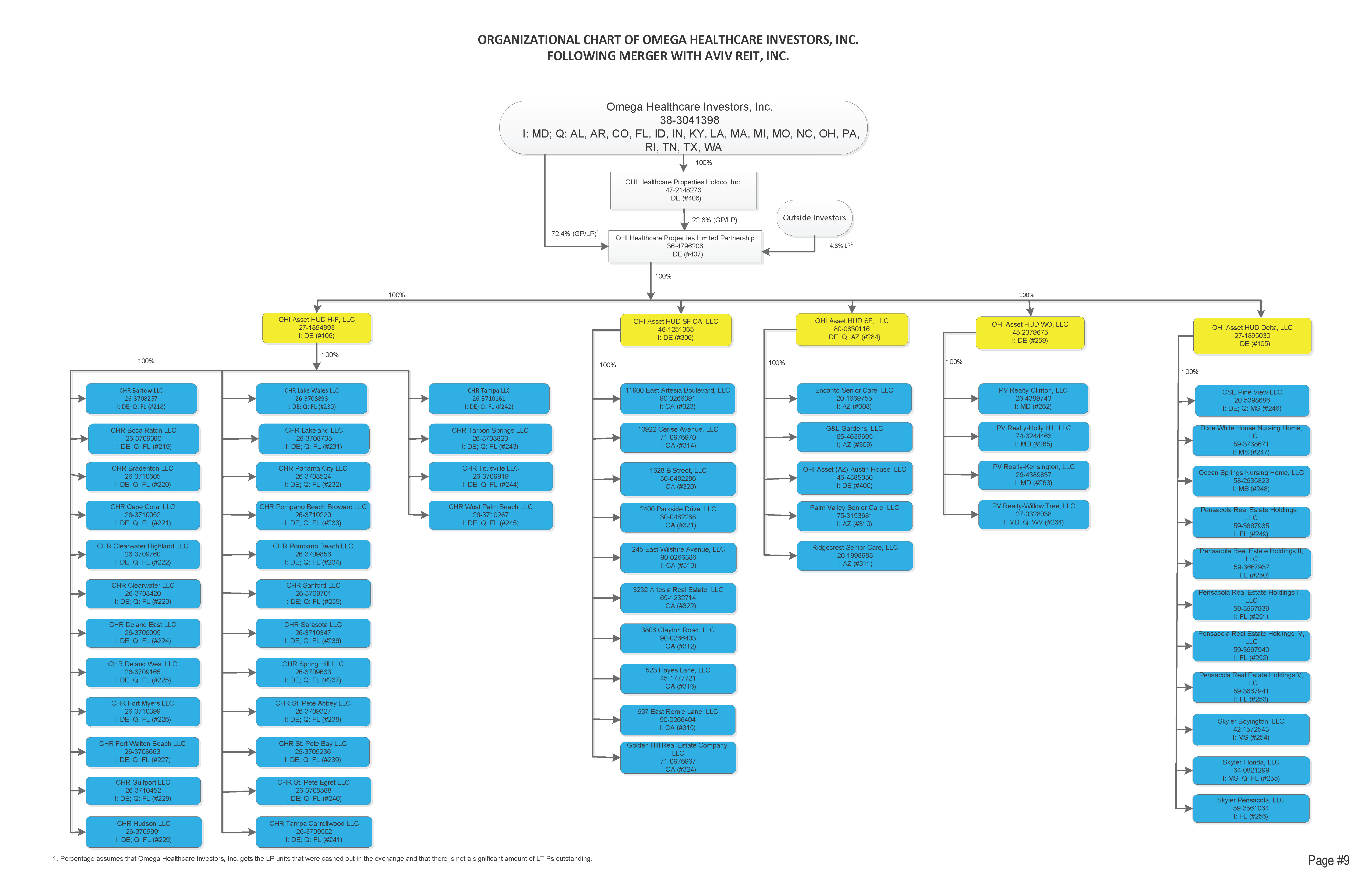

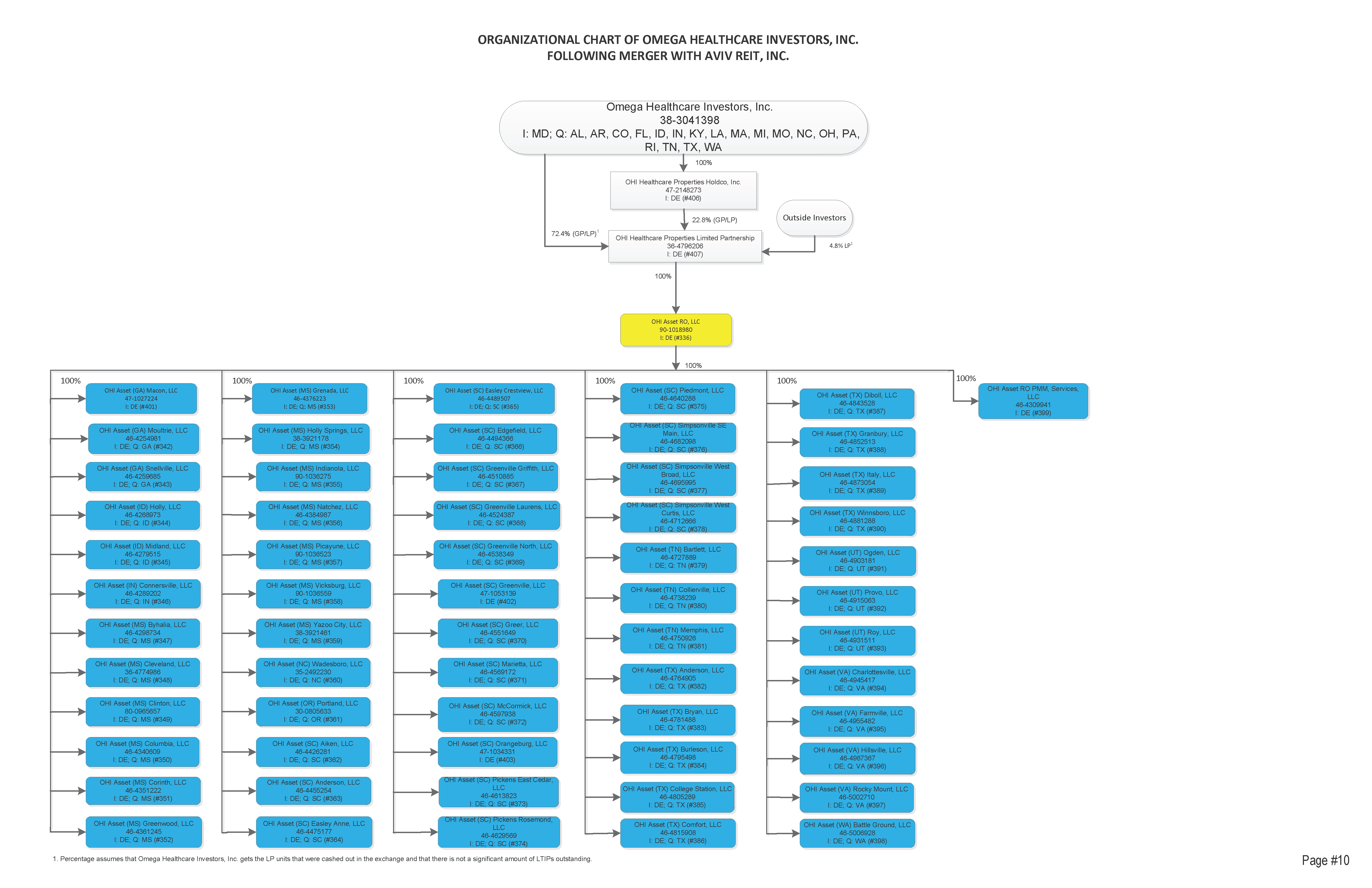

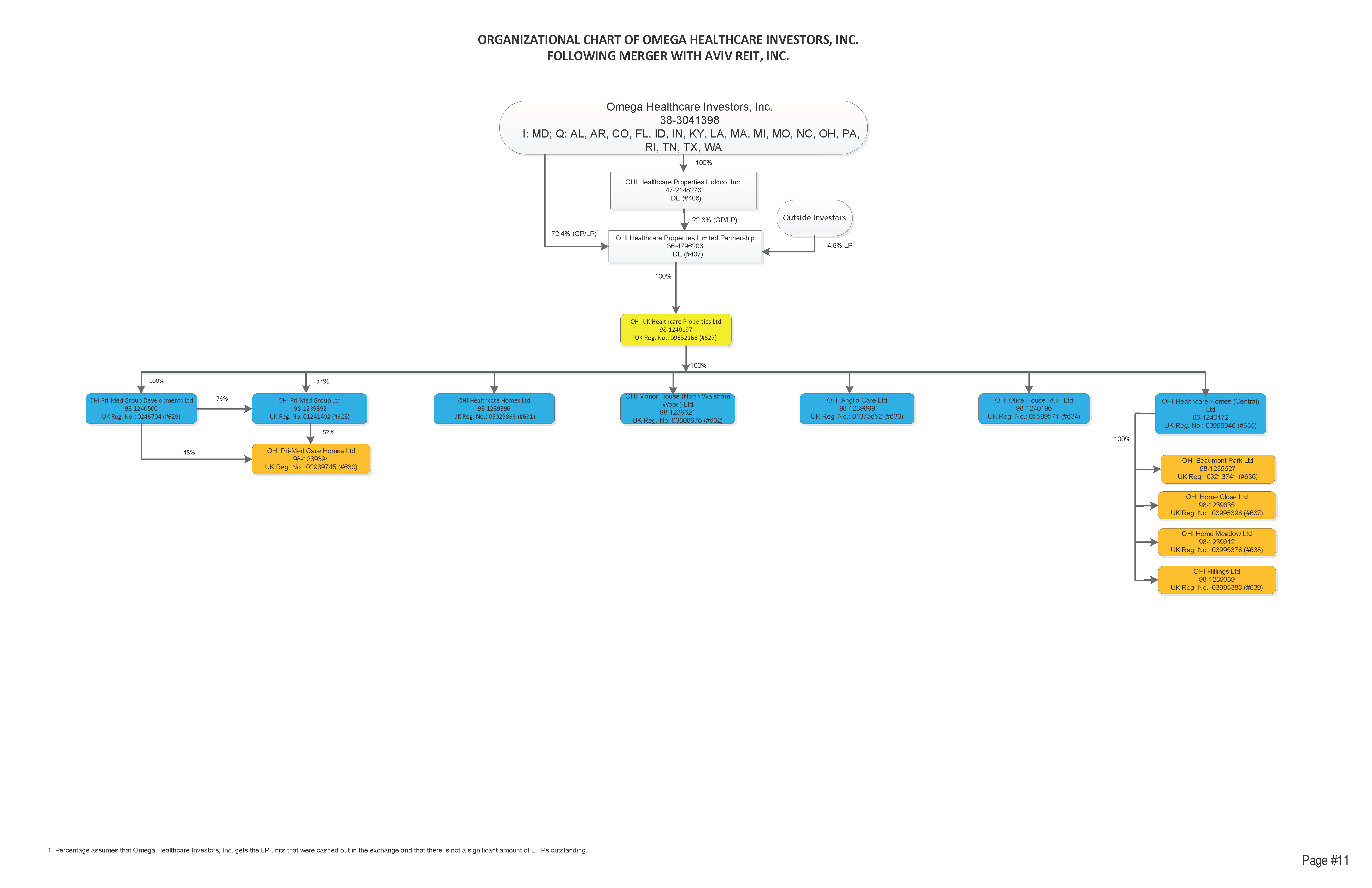

| 5.11 | Corporate Structure; Capital Stock |

| 5.20 | Consolidated Parties |

| 7.01 | Liens |

| 7.02 | Indebtedness |

| 7.03 | Investments |

| 7.09 | Negative Pledges |

| 10.02 | Notice Addresses |

EXHIBITS

| A | Form of Loan Notice |

| B | Form of Term Note |

| C | Form of Compliance Certificate |

| D | Form of Assignment and Assumption |

| E | Form of Subsidiary Guarantor Joinder Agreement |

| F | Form of Lender Joinder Agreement |

v

CREDIT AGREEMENT

This CREDIT AGREEMENT (as amended, modified, restated or supplemented from time to time, this “Credit Agreement” or this “Agreement”) is entered into as of December 16, 2015 by and among OMEGA HEALTHCARE INVESTORS, INC., a Maryland corporation (the “Borrower”) certain subsidiaries of the Borrower identified herein, as Guarantors, the Lenders (as defined herein), and THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., as Administrative Agent (as defined herein).

WHEREAS, the Borrower has requested that the Term Loan Lenders hereunder provide a term loan facility in the amount of $250,000,000 (the “Term Loan Facility”), which Term Loan Facility may be increased to an aggregate amount of $400,000,000;

WHEREAS, to provide assurance for the repayment of the Loans hereunder and the other Obligations of the Credit Parties, the Borrower will, among other things, provide or cause to be provided to the Administrative Agent, for the benefit of the holders of the Obligations so guaranteed, a guaranty of the Obligations by each of the Guarantors pursuant to Article XI hereof;

WHEREAS, subject to the terms and conditions set forth herein, the Administrative Agent is willing to act as administrative agent for the Lenders, and each of the Term Loan Lenders is willing to make Term Loans as provided herein in an aggregate amount at any one time outstanding not in excess of such Term Loan Lender’s Term Loan Commitment hereunder.

NOW, THEREFORE, in consideration of these premises and the mutual covenants and agreements contained herein, the receipt and sufficiency of which are hereby acknowledged, the parties hereto covenant and agree as follows:

Article

I

DEFINITIONS AND ACCOUNTING TERMS

1.01 Defined Terms.

As used in this Credit Agreement, the following terms have the meanings set forth below (such meanings to be equally applicable to both the singular and plural forms of the terms defined):

“Acquisition” with respect to any Person, means the purchase or acquisition by such Person of any Capital Stock in or any asset of another Person, whether or not involving a merger or consolidation with such other Person.

“Acquisition Leverage Ratio Notice” means a written notice from the Borrower to the Administrative Agent (a) delivered not later than twenty (20) days following the last day of the initial fiscal quarter in which the Borrower seeks to invoke an adjustment to the Consolidated Leverage Ratio and/or the Consolidated Unencumbered Leverage Ratio and (b) which describes the Significant Acquisition which formed the basis for such request (including without limitation, a pro forma calculation of the Consolidated Leverage Ratio and/or the Consolidated Unencumbered Leverage Ratio, as applicable, immediately prior to and after giving effect to such Significant Acquisition) and otherwise in form and substance reasonably satisfactory to the Administrative Agent.

“Adjusted Consolidated Funded Debt” means, as of any date of determination, the sum of (a) all Consolidated Funded Debt plus (b) the Consolidated Parties’ pro rata share of Funded Debt attributable to interest in Unconsolidated Affiliates.

“Administrative Agent” means The Bank of Tokyo-Mitsubishi UFJ, Ltd., in its capacity as administrative agent for the Lenders under any of the Credit Documents, or any successor administrative agent.

“Administrative Agent’s Office” means the Administrative Agent’s address and, as appropriate, account as set forth on Schedule 10.02, or such other address or account as the Administrative Agent may from time to time notify the Borrower and the Lenders.

“Administrative Questionnaire” means an Administrative Questionnaire in a form supplied by the Administrative Agent.

“Affiliate” means, with respect to any Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified.

“Agent-Related Persons” means the Administrative Agent, together with its Affiliates (including, in the case of Bank of Tokyo in its capacity as the Administrative Agent, the Arranger), and the officers, directors, employees, agents and attorneys-in-fact of such Persons and Affiliates.

“Agreement” has the meaning provided in the introductory paragraph hereof.

“Applicable Percentage” means with respect to any Lender at any time, (a) with respect to such Lender’s portion of any outstanding Term Loan at any time, the percentage (carried out to the ninth decimal place) of the outstanding principal amount of such Term Loan held by such Lender at such time subject to adjustment as provided in Section 2.15, and (b) with respect to such Lender’s Term Loan Commitment at any time, the percentage (carried out to the ninth decimal place) of the aggregate Term Loan Commitments of all Lenders represented by such Lender’s Term Loan Commitment at such time, subject to adjustment as provided in Section 2.15. The initial Applicable Percentage of each Lender is set forth opposite the name of such Lender on Schedule 2.01 or in the Assignment and Assumption pursuant to which such Lender becomes a party hereto or in any documentation executed by such Lender pursuant to Section 2.01(e), as applicable.

“Applicable Rate” means, for any applicable period, the appropriate applicable percentage corresponding to the following percentages per annum, based upon the Debt Ratings at each Pricing Level as set forth below:

2

|

Applicable Rate

|

|||

| Pricing Level | Debt Rating |

Eurodollar Loans |

Base Rate Loans |

| 1 | > A-/A3 | 1.40% | 0.40% |

| 2 | BBB+/Baa1 | 1.45% | 0.45% |

| 3 | BBB/Baa2 | 1.55% | 0.55% |

| 4 | BBB-/Baa3 | 1.80% | 0.80% |

| 5 | <BBB-/Baa3 | 2.35% | 1.35% |

Each change in the Applicable Rate resulting from a publicly announced change in the Debt Rating shall be effective, in the case of an upgrade, during the period commencing on the date of delivery by the Borrower to the Administrative Agent of notice thereof and ending on the day immediately preceding the effective date of the next such change and, in the case of a downgrade, during the period commencing on the date of the public announcement thereof and ending on the day immediately preceding the effective date of the next such change. If at any time the Borrower or Omega LP has only two (2) Debt Ratings, and such Debt Ratings are split, then: (A) if the difference between such Debt Ratings is one ratings category (e.g. Baa2 by Moody’s and BBB- by S&P or Fitch), the Applicable Rate shall be the rate per annum that would be applicable if the higher of the Debt Ratings were used; and (B) if the difference between such Debt Ratings is two ratings categories (e.g. Baa1 by Moody’s and BBB- by S&P), the Applicable Rate shall be the rate per annum that would be applicable if the median of the applicable Debt Ratings were used. If at any time the Borrower or Omega LP has three (3) Debt Ratings, and such Debt Ratings are split, then: (A) if the difference between the highest and the lowest such Debt Ratings is one ratings category (e.g. Baa2 by Moody’s and BBB- by S&P or Fitch), the Applicable Rate shall be the rate per annum that would be applicable if the highest of the Debt Ratings were used; and (B) if the difference between such Debt Ratings is two ratings categories (e.g. Baa1 by Moody’s and BBB- by S&P or Fitch) or more, the Applicable Rate shall be the rate per annum that would be applicable if the average of the two (2) highest Debt Ratings were used; provided, that if such average is not a recognized rating category, then the Applicable Rate shall be the rate per annum that would be applicable if the second highest Debt Rating of the three were used.

“Approved Fund” means any Fund that is administered or managed by (a) a Lender, (b) an Affiliate of a Lender or (c) an entity or an Affiliate of an entity that administers or manages a Lender.

“Arranger” means, collectively, (i) Bank of Tokyo, in its capacity as joint lead arranger and joint book runner and (ii) Capital One, in its capacity as joint lead arranger and joint book runner.

“Assignee Group” means two or more Eligible Assignees that are Affiliates of one another or two or more Approved Funds managed by the same investment advisor.

3

“Assignment and Assumption” means an assignment and assumption entered into by a Lender and an Eligible Assignee (with the consent of any party whose consent is required by Section 10.07(b)), and accepted by the Administrative Agent, in substantially the form of Exhibit D or any other form (including electronic documentation generated by use of an electronic platform) approved by the Administrative Agent and, if such assignment and assumption requires its consent, the Borrower.

“Attorney Costs” means and includes all reasonable and documented fees, expenses and disbursements of any law firm or other external counsel and, without duplication, the allocated reasonable and documented cost of internal legal services and all expenses and disbursements of internal counsel.

“Attributable Principal Amount” means (a) in the case of capital leases, the amount of capital lease obligations determined in accordance with GAAP, (b) in the case of Synthetic Leases, an amount determined by capitalization of the remaining lease payments thereunder as if it were a capital lease determined in accordance with GAAP, (c) in the case of Securitization Transactions, the outstanding principal amount of such financing, after taking into account reserve amounts and making appropriate adjustments, determined by the Administrative Agent in its reasonable judgment and (d) in the case of Sale and Leaseback Transactions, the present value (discounted in accordance with GAAP at the debt rate implied in the applicable lease) of the obligations of the lessee for rental payments during the term of such lease.

“Audited Financial Statements” means the audited consolidated balance sheet of the Borrower and its Consolidated Subsidiaries for the fiscal year ended December 31, 2014, and the related consolidated statements of earnings, shareholders’ equity and cash flows for such fiscal year of the Borrower and its Consolidated Subsidiaries, including the notes thereto; provided, that the Administrative Agent hereby agrees that the Form 10-K of the Borrower delivered to it by the Borrower and containing information for the fiscal year ended December 31, 2014 shall constitute all information required to be delivered as part of the “Audited Financial Statements” for purposes of this Agreement.

“Bank of Tokyo” means The Bank of Tokyo-Mitsubishi UFJ, Ltd., together with its successors.

“Bankruptcy Code” means Title 11 of the United States Code, as the same may be amended from time to time.

4

“Bankruptcy Event” means, with respect to any Person, the occurrence of any of the following: (a) the entry of a decree or order for relief by a court or governmental agency in an involuntary case under any applicable Debtor Relief Law or any other bankruptcy, insolvency or other similar law now or hereafter in effect, or the appointment by a court or governmental agency of a receiver, liquidator, assignee, custodian, trustee, sequestrator (or similar official) of such Person or for any substantial part of its Property or the ordering of the winding up or liquidation of its affairs by a court or governmental agency and such decree, order or appointment is not vacated or discharged within ninety (90) days of its filing; or (b) the commencement against such Person of an involuntary case under any applicable Debtor Relief Law or any other bankruptcy, insolvency or other similar law now or hereafter in effect, or of any case, proceeding or other action for the appointment of a receiver, liquidator, assignee, custodian, trustee, sequestrator (or similar official) of such Person or for any substantial part of its Property or for the winding up or liquidation of its affairs, and such involuntary case or other case, proceeding or other action shall remain undismissed for a period of ninety (90) consecutive days, or the repossession or seizure by a creditor of such Person of a substantial part of its Property; or (c) such Person shall commence a voluntary case under any applicable Debtor Relief Law or any other bankruptcy, insolvency or other similar law now or hereafter in effect, or consent to the entry of an order for relief in an involuntary case under any such law, or consent to the appointment of or the taking possession by a receiver, liquidator, assignee, creditor in possession, custodian, trustee, sequestrator (or similar official) of such Person or for any substantial part of its Property or make any general assignment for the benefit of creditors; or (d) the filing of a petition by such Person seeking to take advantage of any Debtor Relief Law or any other applicable Law, domestic or foreign, relating to bankruptcy, insolvency, reorganization, winding-up, or composition or adjustment of debts, or (e) such Person shall fail to contest in a timely and appropriate manner (and if not dismissed within ninety (90) days) or shall consent to any petition filed against it in an involuntary case under such bankruptcy laws or other applicable Law or consent to any proceeding or action relating to any bankruptcy, insolvency, reorganization, winding-up, or composition or adjustment of debts with respect to its assets or existence, or (f) such Person shall admit in writing, or such Person’s financial statements shall reflect, an inability to pay its debts generally as they become due.

“Base Rate” means for any day a fluctuating rate per annum equal to the highest of (a) the Federal Funds Rate plus 0.50%, (b) the rate of interest in effect for such day as publicly announced from time to time by Bank of Tokyo as its “prime rate,” and (c) the one-month Eurodollar Rate plus one percent (1.00%); and if Base Rate shall be less than zero, such rate shall be deemed zero for purposes of this Agreement. The “prime rate” is a rate set by Bank of Tokyo based upon various factors including Bank of Tokyo’s costs and desired return, general economic conditions and other factors, and is used as a reference point for pricing some loans, which may be priced at, above, or below such announced rate. Any change in the prime rate announced by Bank of Tokyo shall take effect at the opening of business on the day specified in the public announcement of such change.

“Base Rate Loan” means a Loan that bears interest based on the Base Rate.

“Borrower” has the meaning given to such term in the introductory paragraph hereof.

“Borrower Materials” has the meaning provided in Section 6.02.

“Borrowing” means a borrowing consisting of simultaneous Loans of the same Type and, in the case of Eurodollar Loans, having the same Interest Period.

“Braswell Indebtedness” means that certain Indebtedness of Regency Health Services, Inc. owing to C. Allen Braswell, Braswell Management, Inc., Dorothy Norton and Cecil Mays pursuant to that certain Promissory Note Secured by Deeds of Trust in the original principal amount of $4,114,035 (of which no more than $2,961,607 was outstanding as of June 27, 2014).

“Businesses” has the meaning provided in Section 5.07(a).

5

“Business Day” means any day other than a Saturday, Sunday or other day on which commercial banks are authorized to close under the Laws of, or are in fact closed in, the state where the Administrative Agent’s Office is located and, if such day relates to any Eurodollar Loan, means any such day that is also a London Banking Day.

“Capital Lease” means a lease that would be capitalized on a balance sheet of the lessee prepared in accordance with GAAP.

“Capital One” means Capital One, National Association, together with its successors.

“Capital Stock” means (a) in the case of a corporation, capital stock, (b) in the case of an association or business entity, any and all shares, interests, participations, rights or other equivalents (however designated) of capital stock, (c) in the case of a partnership, partnership interests (whether general or limited), (d) in the case of a limited liability company, membership interests and (e) any other interest or participation that confers on a Person the right to receive a share of the profits and losses of, or distributions of assets of, the issuing Person.

“Capitalization Rate” means 10.0% for all government reimbursed assets (i.e. skilled nursing facilities, hospitals, etc.) and 7.50% for all non-government reimbursed assets (i.e. assisted living facilities, independent living facilities, medical office buildings, etc.).

“Cash Equivalents” means (a) securities issued or directly and fully guaranteed or insured by the United States or any agency or instrumentality thereof (provided that the full faith and credit of the United States is pledged in support thereof) having maturities of not more than twelve months from the date of acquisition, (b) time deposits and certificates of deposit of (i) any Lender, (ii) any domestic commercial bank of recognized standing having capital and surplus in excess of $500,000,000 or (iii) any bank whose short-term commercial paper rating from S&P is at least A-1 or the equivalent thereof or from Moody’s is at least P-1 or the equivalent thereof (each an “Approved Bank”), in each case with maturities of not more than two hundred seventy (270) days from the date of acquisition, (c) commercial paper and variable or fixed rate notes issued by any Approved Bank (or by the parent company thereof) or any variable rate notes issued by, or guaranteed by, any domestic corporation rated A-1 (or the equivalent thereof) or better by S&P or P-1 (or the equivalent thereof) or better by Moody’s and maturing within six months of the date of acquisition, (d) repurchase agreements entered into by any Person with a bank or trust company (including any of the Lenders) or recognized securities dealer having capital and surplus in excess of $500,000,000 for direct obligations issued by or fully guaranteed by the United States in which such Person shall have a perfected first priority security interest (subject to no other Liens) and having, on the date of purchase thereof, a fair market value of at least 100% of the amount of the repurchase obligations and (e) Investments (classified in accordance with GAAP as current assets) in money market investment programs registered under the Investment Company Act of 1940, as amended, that are administered by reputable financial institutions having capital of at least $500,000,000 and the portfolios of which are limited to Investments of the character described in the foregoing subclauses hereof.

6

“Change in Law” means the occurrence, after the Closing Date, of any of the following: (a) the adoption or taking effect of any law, rule, regulation or treaty, (b) any change in any law, rule, regulation or treaty or in the administration, interpretation, implementation or application thereof by any Governmental Authority or (c) the making or issuance of any request, rule, guideline or directive (whether or not having the force of law) by any Governmental Authority; provided that notwithstanding anything herein to the contrary, (x) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder or issued in connection therewith and (y) all requests, rules, guidelines or directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to Basel III, shall in each case be deemed to be a “Change in Law”, regardless of the date enacted, adopted or issued.

“Change of Control” means the occurrence of any of the following events: (a) any Person or two or more Persons acting in concert shall have acquired beneficial ownership, directly or indirectly, of, or shall have acquired by contract or otherwise, or shall have entered into a contract or arrangement that, upon consummation, will result in its or their acquisition of or control over, voting stock of the Borrower (or other securities convertible into such voting stock) representing thirty-five percent (35%) or more of the combined voting power of all voting stock of the Borrower, (b) during any period of up to twenty-four (24) consecutive months, commencing after the Closing Date, individuals who at the beginning of such twenty-four (24) month period were directors of the Borrower (together with any new director whose election by the Borrower’s Board of Directors or whose nomination for election by the Borrower’s shareholders was approved by a vote of at least two-thirds of the directors then still in office who either were directors at the beginning of such period or whose election or nomination for election was previously so approved) cease for any reason to constitute a majority of the directors of the Borrower then in office, (c) the occurrence of a “Change of Control” or any equivalent term or concept under any of the Senior Note Indentures, (d) the Borrower ceases to be a general partner of Omega LP or ceases to have the sole and exclusive power to exercise all management and control over Omega LP, (e) any Person other than the Borrower or Omega Holdco becomes a general partner of Omega LP, or (f) the Borrower ceases to own, directly or indirectly, sixty percent (60%) or more of the equity interests in Omega LP. As used herein, “beneficial ownership” shall have the meaning provided in Rule 13d-3 of the SEC under the Securities Exchange Act of 1934.

“Closing Date” means the date hereof.

“Commitment” means with respect to each Lender, the Term Loan Commitment of such Lender.

“Commitment Increase Amendment” has the meaning set forth in Section 2.01(f).

“Commodity Exchange Act” means the Commodity Exchange Act (7 U.S.C. § et seq.).

“Compliance Certificate” means a certificate substantially in the form of Exhibit C.

“Confidential Information” has the meaning provided in Section 10.08.

“Consolidated Adjusted EBITDA” means, for any period, for the Consolidated Parties on a consolidated basis, the sum of (a) Consolidated EBITDA as of such date plus (b) an amount based on the Special Charges Adjustment (without duplication to the extent included in the determination of Consolidated Interest Expense and added back to net income in the calculation of Consolidated EBITDA).

7

“Consolidated EBITDA” means, for any period, for the Consolidated Parties on a consolidated basis, the sum of (a) net income of the Consolidated Parties, in each case, excluding any non-recurring or extraordinary gains and losses, plus (b) an amount which, in the determination of net income for such period pursuant to clause (a) above, has been deducted for or in connection with (i) Consolidated Interest Expense (plus, amortization of deferred financing costs, to the extent included in the determination of Consolidated Interest Expense per GAAP), (ii) income taxes, and (iii) depreciation and amortization plus (c) to the extent decreasing net income of the Consolidated Parties for such period, all expenses directly attributable to FIN 46 consolidation requirements, minus (d) to the extent increasing net income of the Consolidated Parties for such period, all revenue directly attributable to FIN 46 consolidation requirements, plus (e) to the extent decreasing net income of the Consolidated Parties for such period, all expenses directly related to owned and operated assets, minus (f) to the extent increasing net income of the Consolidated Parties for such period, all revenues directly related to owned and operated assets, all determined in accordance with GAAP.

“Consolidated Fixed Charge Coverage Ratio” means, as of any date of determination, the ratio of (a) Consolidated Adjusted EBITDA to (b) Consolidated Fixed Charges, in each case, for the most recently completed four (4) fiscal quarters.

“Consolidated Fixed Charges” means, for any period, for the Consolidated Parties on a consolidated basis, the sum of (a) Consolidated Interest Expense (excluding, for purposes hereof and without duplication, Special Charges to the extent included in the calculation of Consolidated Interest Expense) for such period, plus (b) current scheduled principal payments of Consolidated Funded Debt for such period (including, for purposes hereof, current scheduled reductions in commitments, but excluding any payment of principal under the Credit Documents and any “balloon” payment or final payment at maturity that is significantly larger than the scheduled payments that preceded it) for a period beginning the day after the date of determination and lasting for the same length of time as the applicable period referenced at the beginning of this definition, plus (c) dividends and distributions on preferred stock, if any, for such period, in each case, as determined in accordance with GAAP.

“Consolidated Funded Debt” means, as of any date of determination, the sum of (a) all Funded Debt of the Consolidated Parties determined on a consolidated basis minus (b) to the extent included in the calculation of Funded Debt of the Consolidated Parties, the aggregate amount of Funded Debt directly attributable to FIN 46 consolidation requirements, all determined in accordance with GAAP.

“Consolidated Interest Expense” means, for any period, for the Consolidated Parties on a consolidated basis, all interest expense and letter of credit fee expense, as determined in accordance with GAAP during such period; provided, that interest expenses shall, in any event, (a) include the interest component under Capital Leases and the implied interest component under Securitization Transactions and (b) exclude the amortization of any deferred financing fees.

8

“Consolidated Leverage Ratio” means, as of any date of determination, the ratio of (a) Adjusted Consolidated Funded Debt to (b) Consolidated Total Asset Value for the most recently completed fiscal quarter.

“Consolidated Parties” means the Borrower and its Consolidated Subsidiaries, as determined in accordance with GAAP.

“Consolidated Secured Funded Debt” means the aggregate principal amount of Funded Debt of the Borrower or any of its Subsidiaries, on a consolidated basis, that is secured by a Lien, and shall include (without duplication), the ownership share of such secured Funded Debt of the Borrower’s or its Subsidiaries’ Unconsolidated Affiliates.

“Consolidated Secured Leverage Ratio” means, as of any date of determination, the ratio of (a) Consolidated Secured Funded Debt to (b) Consolidated Total Asset Value for the most recently completed fiscal quarter.

“Consolidated Subsidiary” means at any date any Subsidiary or other entity the accounts of which would be consolidated with those of the Borrower in its consolidated financial statements if such statements were prepared as of such date.

“Consolidated Tangible Net Worth” means, for the Consolidated Parties as of any date of determination, (a) stockholders’ equity on a consolidated basis determined in accordance with GAAP, but with no upward adjustments due to any revaluation of assets, less (b) all Intangible Assets, plus (c) all accumulated depreciation, all determined in accordance with GAAP; provided, that the Consolidated Parties will be permitted to exclude (i.e. add back to stockholder’s equity) up to $35,000,000 in potential future impairment charges incurred on or after June 27, 2014 (such exclusions to be clearly reflected, however, in the calculations of Consolidated Tangible Net Worth delivered to the Administrative Agent by the Borrower from time to time pursuant to the terms of this Credit Agreement).

“Consolidated Total Asset Value” means the sum of all the following of the Consolidated Parties, without duplication: (a) the quotient of (1) Net Revenue from all Real Property Assets for the fiscal quarter most recently ended (for Real Property Assets owned for the prior four (4) fiscal quarters), minus the Net Revenue attributable to each Real Property Asset sold or otherwise disposed of during such most recently ended quarter, minus the Net Revenue from all Real Property Assets acquired during the prior four (4) fiscal quarter period, multiplied by four, divided by (2) the Capitalization Rate, plus (b) the acquisition cost of each Real Property Asset acquired during the prior four (4) fiscal quarter period, plus (c) the GAAP book value of the Borrower’s Investments permitted by Section 7.03, plus (d) cash and cash equivalents, plus (e) the Consolidated Parties’ pro rata share of the foregoing items and components attributable to interest in Unconsolidated Affiliates.

“Consolidated Unsecured Debt Yield” means, as of any date of determination, the ratio of (a) Unencumbered Net Revenue plus interest income from unencumbered Qualified Mortgage Loans (provided, however, the aggregate amount of Qualified Mortgage Loans attributable to second mortgages or second deeds of trust shall not exceed $150,000,000), as of the end of the most recently completed fiscal quarter multiplied by four (4) to (b) the Consolidated Unsecured Funded Debt for the most recently completed fiscal quarter.

9

“Consolidated Unsecured Funded Debt” mean the aggregate principal amount of Funded Debt of the Borrower or any of its Subsidiaries, on a consolidated basis, that is not Consolidated Secured Funded Debt.

“Consolidated Unsecured Interest Coverage Ratio” means, as of any date of determination, the ratio of (a) Unencumbered Net Revenue for the most recently completed fiscal quarter to (b) the Consolidated Unsecured Interest Expense for the most recently completed fiscal quarter.

“Consolidated Unsecured Interest Expense” means, for any period, for the Consolidated Parties on a consolidated basis, all interest expense and letter of credit fee expense, as determined in accordance with GAAP during such period, attributable to the Borrower and its Subsidiaries’ aggregate Consolidated Unsecured Funded Debt; provided, that interest expenses shall, in any event, (a) include the interest component under Capital Leases and the implied interest component under Securitization Transactions and (b) exclude the amortization of any deferred financing fees.

“Consolidated Unsecured Leverage Ratio” means, as of any date of determination, the ratio of (a) Consolidated Unsecured Funded Debt to (b) Unencumbered Asset Value for the most recently completed fiscal quarter.

“Contractual Obligation” means, as to any Person, any provision of any security issued by such Person or of any agreement, instrument or other undertaking to which such Person is a party or by which it or any of its property is bound.

“Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. “Controlling” and “Controlled” have meanings correlative thereto. Without limiting the generality of the foregoing, a Person shall be deemed to be Controlled by another Person if such other Person possesses, directly or indirectly, power to vote twenty-five percent (25%) or more of the securities having ordinary voting power for the election of directors, managing general partners or the equivalent.

“Credit Agreement” has the meaning given to such term in the introductory paragraph hereof.

“Credit Documents” means this Credit Agreement, the Notes, the Engagement Letter, the Subsidiary Guarantor Joinder Agreements and the Compliance Certificates.

“Credit Party” means, as of any date, the Borrower or any Guarantor which is a party to the Credit Agreement as of such date; and “Credit Parties” means a collective reference to each of them.

10

“Debt Rating” means, as of any date of determination, the rating as determined by S&P, Moody’s and/or Fitch of the Borrower’s or Omega LP’s non-credit-enhanced, senior unsecured long-term debt.

“Debtor Relief Laws” means the Bankruptcy Code, and all other liquidation, conservatorship, bankruptcy, assignment for the benefit of creditors, moratorium, rearrangement, receivership, insolvency, reorganization, or similar debtor relief Laws of the United States or other applicable jurisdictions from time to time in effect and affecting the rights of creditors generally.

“Default” means any event, act or condition that, with notice, the passage of time, or both, would constitute an Event of Default.

“Default Rate” means an interest rate equal to (a) the Base Rate plus (b) the Applicable Rate, if any, applicable to Base Rate Loans plus (c) two percent (2%) per annum; provided, however, that with respect to a Eurodollar Loan, the Default Rate shall be an interest rate equal to the interest rate (including any Applicable Rate) otherwise applicable to such Loan plus two percent (2%) per annum, in each case to the fullest extent permitted by applicable Law.

“Defaulting Lender” means, subject to Section 2.15(b), any Lender that, as reasonably determined by the Administrative Agent, (a) has failed to perform any of its funding obligations hereunder, including in respect of its Loans within three Business Days of the date required to be funded by it hereunder, unless, in the case of any Loan, such Lender notifies the Administrative Agent and the Borrower in writing that such failure is the result of such Lender’s reasonable determination that one or more conditions precedent to funding (each of which conditions precedent, together with any applicable default, shall be specifically identified in such writing) has not been satisfied, (b) has notified the Borrower or the Administrative Agent in writing that it does not intend to comply with its funding obligations or has made a public statement to that effect with respect to its funding obligations hereunder or under other agreements in which it commits to extend credit (unless such writing or public statement relates to such Lender’s obligation to fund a Loan hereunder and states that such position is based on such Lender’s reasonable determination that a condition precedent to funding (which condition precedent, together with any applicable default, shall be specifically identified in such writing or public statement) cannot be satisfied), (c) has failed, within three Business Days after request by the Administrative Agent, to confirm in a manner satisfactory to the Administrative Agent that it will comply with its funding obligations (provided that such Lender shall cease to be a Defaulting Lender pursuant to this clause (c) upon receipt of such written confirmation by the Administrative Agent and the Borrower), or (d) has, or has a direct or indirect parent company that has, (i) become the subject of a proceeding under any Debtor Relief Law, (ii) had a receiver, conservator, trustee, administrator, assignee for the benefit of creditors or similar Person charged with reorganization or liquidation of its business or a custodian appointed for it, or (iii) taken any action in furtherance of, or indicated its consent to, approval of or acquiescence in any such proceeding or appointment; provided, that a Lender shall not be a Defaulting Lender solely by virtue of the ownership or acquisition of any equity interest in that Lender or any direct or indirect parent company thereof by a Governmental Authority so long as such ownership interest does not result in or provide such Lender with immunity from the jurisdiction of courts within the United States or from the enforcement of judgments or writs of attachment on its assets or permit such Lender (or such Governmental Authority) to reject, repudiate, disavow or disaffirm any contracts or agreements made with such Lender. Any determination by the Administrative Agent that a Lender is a Defaulting Lender under any one or more of clauses (a) through (d) above, and of the effective date of such status, shall be conclusive and binding absent manifest error, and such Lender shall be deemed to be a Defaulting Lender (subject to Section 2.15(b)) as of the date established therefor by the Administrative Agent in a written notice of such determination, which shall be delivered by the Administrative Agent to the Borrower and each Lender promptly following such determination.

11

“Designated Jurisdiction” means any country or territory to the extent that such country or territory itself is the subject of any Sanction.

“Disposition” or “Dispose” means the sale, transfer, license, lease or other disposition (including any Sale and Leaseback Transaction) of any property by any Person, including any sale, assignment, transfer or other disposal, with or without recourse, of any notes or accounts receivable or any rights and claims associated therewith.

“Dollar” or “$” means the lawful currency of the United States.

“Domestic Subsidiary” means any Subsidiary of the Borrower that is organized under the laws of the United States or any state thereof or the District of Columbia.

“Eligible Assignee” means (a) a Lender; (b) an Affiliate of a Lender; (c) an Approved Fund; and (d) any other Person (other than a natural person) approved by (i) the Administrative Agent (such approval not to be unreasonably withheld or delayed), and (ii) unless an Event of Default has occurred and is continuing, the Borrower (each such approval not to be unreasonably withheld or delayed); provided, that notwithstanding the foregoing, “Eligible Assignee” shall not include the Borrower or any of the Borrower’s Affiliates or Subsidiaries.

“Eligible Ground Lease” means, at any time, a ground lease (a) under which the Borrower or a Subsidiary of the Borrower is the lessee or holds equivalent rights and is the fee owner of the improvements located thereon, (b) that has a remaining term of not less than thirty (30) years; provided, however, with respect to that certain ground lease covering properties located at 200 Alabama Avenue, Muscle Shoals, Alabama, 500 John Aldridge Drive, Tuscumbia, Alabama and 813 Keeler Lane, Tuscumbia, Alabama, such remaining term may be less than thirty (30) years provided that the Borrower or such Subsidiary of the Borrower at all times possesses a valid and enforceable irrevocable option to purchase the fee interest in such properties with no conditions or contingencies other than the payment of a sum of less than $1,000.00, (c) under which any required rental payment, principal or interest payment or other payment due under such lease from the Borrower or from such Subsidiary of the Borrower to the ground lessor is not more than sixty (60) days past due and any required rental payment, principal or interest payment or other payment due to such Borrower or Subsidiary of the Borrower under any sublease of the applicable real property lessor is not more than sixty (60) days past due, (d) where no party to such lease is subject to a then-continuing Bankruptcy Event, (e) such ground lease (or a related document executed by the applicable ground lessor) contains customary provisions protective of any lender to the lessee and (f) where the Borrower’s or such Subsidiary of the Borrower’s interest in the underlying Real Property Asset or the lease is not subject to (i) any Lien other than Permitted Liens and other encumbrances acceptable to the Administrative Agent and the Required Lenders, in their discretion, or (ii) any Negative Pledge.

12

“Engagement Letter” means the letter agreement dated as of November 3, 2015 among the Borrower, the Administrative Agent and Capital One, as amended and modified.

“Environmental Laws” means any and all federal, state, local, and foreign statutes, laws, regulations, ordinances, rules, judgments, orders, decrees, permits, concessions, grants, franchises, licenses, agreements or governmental restrictions relating to pollution and the protection of the environment or the release of any materials into the environment, including those related to hazardous substances or wastes, air emissions and discharges to waste or public systems.

“Equity Transaction” means, with respect to any member of the Consolidated Parties, any issuance or sale of shares of its Capital Stock, other than an issuance (a) to a Consolidated Party, (b) in connection with a conversion of debt securities to equity, (c) in connection with the exercise by a present or former employee, officer or director under a stock incentive plan, stock option plan or other equity-based compensation plan or arrangement, or (d) in connection with any acquisition permitted hereunder.

“ERISA” means the Employee Retirement Income Security Act of 1974.

“ERISA Affiliate” means any trade or business (whether or not incorporated) under common control with the Borrower within the meaning of Section 414(b) or (c) of the Internal Revenue Code (and Sections 414(m) and (o) of the Internal Revenue Code for purposes of provisions relating to Section 412 of the Internal Revenue Code).

“ERISA Event” means (a) a Reportable Event with respect to a Pension Plan; (b) a withdrawal by the Borrower or any ERISA Affiliate from a Pension Plan subject to Section 4063 of ERISA during a plan year in which it was a substantial employer (as defined in Section 4001(a)(2) of ERISA) or a cessation of operations that is treated as such a withdrawal under Section 4062(e) of ERISA; (c) a complete or partial withdrawal by the Borrower or any ERISA Affiliate from a Multiemployer Plan or notification that a Multiemployer Plan is in reorganization; (d) the filing of a notice of intent to terminate, the treatment of a Plan amendment as a termination under Sections 4041 or 4041A of ERISA, or the commencement of proceedings by the PBGC to terminate a Pension Plan or Multiemployer Plan; (e) an event or condition that could reasonably be expected to constitute grounds under Section 4042 of ERISA for the termination of, or the appointment of a trustee to administer, any Pension Plan or Multiemployer Plan; or (f) the imposition of any liability under Title IV of ERISA, other than for PBGC premiums due but not delinquent under Section 4007 of ERISA, upon the Borrower or any ERISA Affiliate.

“Eurodollar Loan” means a Loan that bears interest at a rate based on clause (a) of the definition of “Eurodollar Rate.”

13

“Eurodollar Rate” means

(a) For any Interest Period with respect to a Eurodollar Loan, the rate per annum equal to the London Interbank Offered Rate (“LIBOR”) or a comparable or successor rate, which rate is approved by the Administrative Agent, as published by Bloomberg (or such other commercially available source providing such quotations as may be designated by the Administrative Agent from time to time) (in such case, the “LIBOR Rate”) at approximately 11:00 a.m., London time, two (2) Business Days prior to the commencement of such Interest Period, for Dollar deposits (for delivery on the first day of such Interest Period) with a term equivalent to such Interest Period; and if the Eurodollar Rate shall be less than zero, such rate shall be deemed zero for purposes of this Agreement unless such Eurodollar Loan is subject to a Swap Contract;

(b) For any interest calculation with respect to a Base Rate Loan on any date, the rate per annum equal to the LIBOR Rate, at approximately 11:00 a.m., London time, determined two (2) Business Days prior to such date for Dollar deposits with a term of one month commencing that day;

provided, that to the extent a comparable or successor rate is approved by the Administrative Agent in connection herewith, the approved rate shall be applied in a manner consistent with market practice; and, provided, further, that to the extent such market practice is not administratively feasible for the Administrative Agent, such approved rate shall be applied in a manner as otherwise reasonably determined by the Administrative Agent.

“Event of Default” has the meaning provided in Section 8.01.

“Excluded Swap Obligation” means, with respect to any Guarantor, any Obligation under any Swap Contract if, and to the extent that, all or a portion of the Guaranty of such Guarantor of, or the grant under a Credit Document by such Guarantor of a security interest to secure, such Obligation (or any Guarantee thereof) is or becomes illegal under the Commodity Exchange Act (or the application or official interpretation thereof) by virtue of such Guarantor’s failure for any reason to constitute an “eligible contract participant” as defined in the Commodity Exchange Act (determined after giving effect to Section 11.07 and any and all guarantees of such Guarantor’s Obligations under any Swap Contract by other Credit Parties) at the time the Guaranty of such Guarantor, or grant by such Guarantor of a security interest, becomes effective with respect to such Obligation. If an Obligation under any Swap Contract arises under a Master Agreement governing more than one Swap Contract, such exclusion shall apply to only the portion of such Obligations that is attributable to Swap Contracts for which such Guaranty or security interest becomes illegal.

“Executive Order” has the meaning provided in the definition of “Prohibited Person” in this Section 1.01.

“Existing Credit Facility” means that certain Credit Agreement, dated as of June 27, 2014, by and among the Borrower, as borrower, certain subsidiaries of the Borrower, as guarantors, the financial institutions party thereto from time to time, as lenders, and Bank of America, N.A., as administrative agent, as amended, restated, supplemented or otherwise modified from time to time.

14

“Extension of Credit” means any Borrowing.

“Facilities” has the meaning provided in Section 5.07(a).

“Facility Lease” means a lease or master lease with respect to any Real Property Asset owned or ground leased by any of the Consolidated Parties as lessor, to a third party Tenant, which, in the reasonable judgment of the Administrative Agent, is a triple net lease such that such Tenant is required to pay all taxes, utilities, insurance, maintenance, casualty insurance payments and other expenses with respect to the subject Real Property Asset (whether in the form of reimbursements or additional rent) in addition to the base rental payments required thereunder such that net operating income to the applicable Consolidated Party for such Real Property Asset (before non-cash items) equals the base rent paid thereunder; provided, that each such lease or master lease shall be in form and substance reasonably satisfactory to the Administrative Agent.

“FASB” means the Accounting Standards Codification of the Financial Accounting Standards Board.

“FATCA” means Section 1471 through 1474 of the Internal Revenue Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreements entered into pursuant to Section 1471(b)(1) of the Internal Revenue Code and any applicable intergovernmental agreements.

“Federal Funds Rate” means, for any day, the rate per annum equal to the weighted average of the rates on overnight federal funds transactions with members of the Federal Reserve System arranged by federal funds brokers on such day, as published by the Federal Reserve Bank of New York on the Business Day immediately succeeding such day; provided, that (a) if such day is not a Business Day, the Federal Funds Rate for such day shall be such rate on such transactions on the immediately preceding Business Day as so published on the immediately succeeding Business Day, and (b) if no such rate is so published on such immediately succeeding Business Day, the Federal Funds Rate for such day shall be the average rate (rounded upward, if necessary, to the next 1/100th of 1%) charged to Bank of Tokyo on such day on such transactions as determined by the Administrative Agent.

“Fitch” means Fitch Ratings, a Subsidiary of Fimalac, S.A., and any successor thereto.

“Foreign Lender” has the meaning provided in Section 10.15(a)(i).

“Foreign Subsidiary” means any Subsidiary of the Borrower that is not organized under the laws of the United States or any state thereof or the District of Columbia.

“FRB” means the Board of Governors of the Federal Reserve System of the United States.

15

“Fund” means any Person (other than a natural person) engaged in making, purchasing, holding or otherwise investing in commercial loans and similar extensions of credit in the ordinary course of its business.

“Funded Debt” means, as to any Person (or consolidated group of Persons) at a particular time, without duplication, all of the following, whether or not included as indebtedness or liabilities in accordance with GAAP:

(a) all obligations for borrowed money, whether current or long-term (including the Obligations hereunder), and all obligations evidenced by bonds, debentures, notes, loan agreements or other similar instruments;

(b) all purchase money indebtedness (including indebtedness and obligations in respect of conditional sales and title retention arrangements, except for customary conditional sales and title retention arrangements with suppliers that are entered into in the ordinary course of business) and all indebtedness and obligations in respect of the deferred purchase price of property or services (other than trade accounts payable incurred in the ordinary course of business and payable on customary trade terms);

(c) all direct obligations under letters of credit (including standby and commercial), bankers’ acceptances and similar instruments (including bank guaranties, surety bonds, comfort letters, keep-well agreements and capital maintenance agreements) to the extent such instruments or agreements support financial, rather than performance, obligations;

(d) the Attributable Principal Amount of capital leases and Synthetic Leases;

(e) the Attributable Principal Amount of Securitization Transactions;

(f) all preferred stock and comparable equity interests providing for mandatory redemption, sinking fund or other like payments;

(g) Support Obligations in respect of Funded Debt of another Person (other than Persons in such group, if applicable); and

(h) Funded Debt of any partnership or joint venture or other similar entity in which such Person is a general partner or joint venturer, and, as such, has personal liability for such obligations, but only to the extent there is recourse to such Person (or, if applicable, any Person in such consolidated group) for payment thereof.

For purposes hereof, the amount of Funded Debt shall be determined based on the outstanding principal amount in the case of borrowed money indebtedness under clause (a) and purchase money indebtedness and the deferred purchase obligations under clause (b), based on the maximum amount available to be drawn in the case of letter of credit obligations and the other obligations under clause (c), and based on the amount of Funded Debt that is the subject of the Support Obligations in the case of Support Obligations under clause (g). For purposes of clarification, “Funded Debt” of Person constituting a consolidated group shall not include inter-company indebtedness of such Persons, general accounts payable of such Persons which arise in the ordinary course of business, accrued expenses of such Persons incurred in the ordinary course of business or minority interests in joint ventures or limited partnerships (except to the extent set forth in clause (h) above).

16

“Funds From Operations” means, with respect to any period, the Borrower’s net income (or loss), plus depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures as hereafter provided. Notwithstanding contrary treatment under GAAP, for purposes hereof, (a) “Funds From Operations” shall include, and be adjusted to take into account, the Borrower’s interests in unconsolidated partnerships and joint ventures, on the same basis as consolidated partnerships and subsidiaries, as provided in the “white paper” issued in April 2002 by the National Association of Real Estate Investment Trusts, a copy of which has been provided to the Administrative Agent and the Lenders and (b) net income (or loss) shall not include gains (or, if applicable, losses) resulting from or in connection with (i) restructuring of indebtedness, (ii) sales of property, (iii) sales or redemptions of preferred stock, (iv) revenue or expenses related to owned and operated assets, (v) revenue or expense related to FIN 46 consolidation requirements or (vi) any other Special Charges.

“GAAP” means generally accepted accounting principles in effect in the United States as set forth in the opinions and pronouncements of the Accounting Principles Board and the American Institute of Certified Public Accountants and statements and pronouncements of the Financial Accounting Standards Board from time to time applied on a consistent basis, subject to the provisions of Section 1.03.

“Governmental Authority” means any nation or government, any state or other political subdivision thereof, and any agency, authority, instrumentality, regulatory body, court, administrative tribunal, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government.

“Guaranteed Obligations” has the meaning given to such term in Section 11.01(a).

“Guarantors” means any Subsidiary of the Borrower that guarantees the loans and obligations hereunder pursuant to the Guaranty, in each case with their successors and permitted assigns.

“Guaranty” means the guaranty of the Obligations by each of the Guarantors pursuant to Article XI hereof.

“Hazardous Material” means any toxic or hazardous substance, including petroleum and its derivatives regulated under the Environmental Laws.

“Healthcare Facilities” means any skilled nursing facilities, mentally retarded and developmentally disabled facilities, rehab hospitals, long term acute care facilities, intermediate care facilities for the mentally disabled, medical office buildings, domestic assisted living facilities, independent living facilities or Alzheimer’s care facilities and any ancillary businesses that are incidental to the foregoing.

“Incremental Facilities” has the meaning provided in Section 2.01(e).

17

“Incremental Facility Commitment” has the meaning provided in Section 2.01(e)(iii).

“Incremental Term Loan Facility” has the meaning provided in Section 2.01(e).

“Indebtedness” means, as to any Person at a particular time, without duplication, all of the following, whether or not included as indebtedness or liabilities in accordance with GAAP:

(a) all Funded Debt;

(b) all contingent obligations under letters of credit (including standby and commercial), bankers’ acceptances and similar instruments (including bank guaranties, surety bonds, comfort letters, keep-well agreements and capital maintenance agreements) to the extent such instruments or agreements support financial, rather than performance, obligations;

(c) net obligations under any Swap Contract;

(d) Support Obligations in respect of Indebtedness of another Person; and

(e) Indebtedness of any partnership or joint venture or other similar entity in which such Person is a general partner or joint venturer, and, as such, has personal liability for such obligations, but only to the extent there is recourse to such Person for payment thereof.

For purposes hereof, the amount of Indebtedness shall be determined based on Swap Termination Value in the case of net obligations under Swap Contracts under clause (c) and based on the outstanding principal amount of the Indebtedness that is the subject of the Support Obligations in the case of Support Obligations under clause (d).

“Indemnified Liabilities” has the meaning provided in Section 10.05.

“Indemnitees” has the meaning provided in Section 10.05.

“Intangible Assets” means all assets consisting of goodwill, patents, trade names, trademarks, copyrights, franchises, experimental expense, organization expense, unamortized debt discount and expense, deferred assets (other than prepaid insurance and prepaid taxes), the excess of cost of shares acquired over book value of related assets and such other assets as are properly classified as “intangible assets” in accordance with GAAP.

“Interest Payment Date” means, (a) as to any Base Rate Loan, the last Business Day of each March, June, September and December and the Term Loan Maturity Date, and (b) as to any Eurodollar Loan, the last Business Day of each Interest Period for such Loan, the date of repayment of principal of such Loan, and where the applicable Interest Period exceeds three months, the date every three months after the beginning of such Interest Period. If an Interest Payment Date falls on a date that is not a Business Day, such Interest Payment Date shall be deemed to be the immediately succeeding Business Day.

18

“Interest Period” means, as to each Eurodollar Loan, the period commencing on the date such Eurodollar Loan is disbursed or converted to or continued as a Eurodollar Loan and ending on the date one, two, three or six months thereafter, as selected by the Borrower in its Loan Notice; provided, that:

(a) any Interest Period that would otherwise end on a day that is not a Business Day shall be extended to the immediately succeeding Business Day unless such Business Day falls in another calendar month, in which case such Interest Period shall end on the immediately preceding Business Day;

(b) any Interest Period that begins on the last Business Day of a calendar month (or on a day for which there is no numerically corresponding day in the calendar month at the end of such Interest Period) shall end on the last Business Day of the calendar month at the end of such Interest Period; and

(c) no Interest Period shall extend beyond the Term Loan Maturity Date.

“Internal Revenue Code” means the Internal Revenue Code of 1986 as amended.

“International Unencumbered Property” means an Unencumbered Property which is located in Australia, Canada, Switzerland or the United Kingdom.

“Investment” means, as to any Person, any direct or indirect acquisition or investment by such Person, whether by means of (a) the purchase or other acquisition of Capital Stock of another Person, (b) a loan, advance or capital contribution to, guaranty or assumption of debt of, or purchase or other acquisition of any other debt or equity participation or interest in, another Person, including any partnership or joint venture interest in such other Person, or (c) the purchase or other acquisition (in one transaction or a series of transactions) of assets of another Person that constitute a business unit. For purposes of covenant compliance, the amount of any Investment shall be the amount actually invested, without adjustment for subsequent increases or decreases in the value of such Investment.

“Investment Grade Rating” means a Debt Rating of BBB-/Baa3 (or equivalent) or higher from any of Moody’s, S&P or Fitch.

“Investor Guarantor” means any of the limited partners (other than the Borrower or any Subsidiary of the Borrower) of Omega LP that are a party to the Investor Guaranty.

“Investor Guaranty” means a guaranty which may be executed and delivered by one or more Investor Guarantors in accordance with Section 6.19, in a form approved by Administrative Agent, which approval shall not be unreasonably withheld, delayed or conditioned, as the same may be amended, supplemented or otherwise modified from time to time.

“IRS” means the United States Internal Revenue Service.

19

“Laws” means, collectively, all international, foreign, federal, state and local statutes, treaties, rules, guidelines, regulations, ordinances, codes and administrative or judicial precedents or authorities, including the interpretation or administration thereof by any Governmental Authority charged with the enforcement, interpretation or administration thereof, and all applicable administrative orders, directed duties, requests, licenses, authorizations and permits of, and agreements with, any Governmental Authority, in each case whether or not having the force of law.

“Lender” means each of the Persons identified as a “Lender” on the signature pages hereto and each Person who joins as a Lender pursuant to the terms hereof, together with their respective successors and assigns.

“Lender Joinder Agreement” means a joinder agreement in the form of Exhibit F, executed and delivered in accordance with the provisions of Section 2.01(e)(vii).

“Lending Office” means, as to any Lender, the office or offices of such Lender set forth in such Lender’s Administrative Questionnaire or such other office or offices as a Lender may from time to time notify the Borrower and the Administrative Agent.

“LIBOR” has the meaning provided in the definition of “Eurodollar Rate” in this Section 1.01.

“LIBOR Rate” has the meaning provided in the definition of “Eurodollar Rate” in this Section 1.01.

“Lien” means any mortgage, deed of trust, deed to secured debt, pledge, hypothecation, assignment, deposit arrangement, encumbrance, lien (statutory or other), charge, or preference, priority or other security interest or preferential arrangement of any kind or nature whatsoever (including any conditional sale or other title retention agreement, and any financing lease having substantially the same economic effect as any of the foregoing).

“Loan” means any Term Loan and the Base Rate Loans and Eurodollar Loans comprising such Loans.

“Loan Notice” means a notice of (a) a Borrowing of Loans, (b) a conversion of Loans from one Type to the other, or (c) a continuation of Eurodollar Loans, which, if in writing, shall be substantially in the form of Exhibit A or such other form as may be approved by the Administrative Agent (including any form on an electronic platform or electronic transmission system as shall be approved by the Administrative Agent), appropriately completed and signed by a Responsible Officer of the Borrower.

“London Banking Day” means any day on which dealings in Dollar deposits are conducted by and between banks in the London interbank eurodollar market.

“LP Credit Agreement” means that certain Credit Agreement, dated as of April 1, 2015, by and among Omega LP, as borrower, certain subsidiaries of Omega LP, as guarantors, the financial institutions party thereto from time to time, as lenders, and Bank of America, N.A., as administrative agent, as amended, restated, supplemented or otherwise modified from time to time.

20

“Master Agreement” has the meaning provided in the definition of “Swap Contract” in this Section 1.01.

“Material Adverse Effect” means a material adverse effect on (a) the condition (financial or otherwise), operations, business, assets, liabilities or prospects of the Borrower and its Consolidated Subsidiaries taken as a whole, (b) the ability of the Borrower or the other Credit Parties, taken as a whole, to perform any material obligation under the Credit Documents, or (c) the rights and remedies of the Administrative Agent and the Lenders under the Credit Documents.

“Material Contract” means, any agreement the breach, nonperformance or cancellation of which could reasonably be expected to have a Material Adverse Effect.

“Material Group” has the meaning specified in the definition of “Material Subsidiary.”

“Material Subsidiary” means each Subsidiary or any group of Subsidiaries (a) which, as of the most recent fiscal quarter of the Borrower for which financial statements have been delivered pursuant to Section 6.01, contributed greater than $10,000,000 of Consolidated EBITDA for the period of four (4) consecutive fiscal quarters then ended or (b) which contributed greater than $50,000,000 of Consolidated Total Asset Value as of such date. A group of Subsidiaries (a “Material Group”) each of which is not otherwise a Material Subsidiary (defined in the foregoing sentence) shall constitute a Material Subsidiary if the group taken as a single entity satisfies the requirements of the foregoing sentence.

“Moody’s” means Moody’s Investors Service, Inc. and any successor thereto.

“Mortgage Loan” means any loan owned or held by any of the Consolidated Parties secured by a mortgage or deed of trust on Real Property Assets.

“Multiemployer Plan” means any employee benefit plan of the type described in Section 4001(a)(3) of ERISA, to which the Borrower or any ERISA Affiliate makes or is obligated to make contributions, or during the preceding five plan years, has made or been obligated to make contributions.

“Negative Pledge” means any agreement (other than this Credit Agreement or any other Credit Document) that in whole or in part prohibits the creation of any Lien on any assets of a Person; provided, however, that an agreement that establishes a maximum ratio of unsecured debt to unencumbered assets, or of secured debt to total assets, or that otherwise conditions a Person’s ability to encumber its assets upon the maintenance of one or more specified ratios that limit such Person’s ability to encumber its assets but that do not generally prohibit the encumbrance of its assets, or the encumbrance of specific assets, shall not constitute a “Negative Pledge” for purposes of this Credit Agreement.

21

“Net Revenue” shall mean, with respect to any Real Property Asset for the applicable period, the sum of (a) rental payments received in cash by the applicable Consolidated Party (whether in the nature of base rent, minimum rent, percentage rent, additional rent or otherwise, but exclusive of security deposits, earnest money deposits, advance rentals, reserves for capital expenditures, charges, expenses or items required to be paid or reimbursed by the Tenant thereunder and proceeds from a sale or other disposition) pursuant to the Facility Leases applicable to such Real Property Asset, minus (b) expenses of the applicable Consolidated Party allocated to such Real Property Asset, minus (c) to the extent increasing Net Revenue of the Consolidated Parties for such period, all revenue directly attributable to FIN 46 consolidation requirements.

“Non-Defaulting Lender” means, at any time, each Lender that is not a Defaulting Lender at such time.

“Notes” means a collective reference to the Term Notes; and “Note” means any one of them.

“Obligations” means, without duplication, (a) all advances to, and debts, liabilities, obligations, covenants and duties of, any Credit Party arising under any Credit Document or otherwise with respect to any Loan, whether direct or indirect (including those acquired by assumption), absolute or contingent, due or to become due, now existing or hereafter arising and including interest and fees that accrue after the commencement by or against any Credit Party or any Affiliate thereof of any proceeding under any Debtor Relief Laws naming such Person as the debtor in such proceeding, regardless of whether such interest and fees are allowed claims in such proceeding, (b) all obligations under any Swap Contract of any Credit Party to which a Lender or any Affiliate of a Lender is a party and (c) all obligations of any Credit Party under any treasury management agreement between any Credit Party and any Lender or Affiliate of a Lender; provided, however, that the “Obligations” of a Credit Party shall exclude any Excluded Swap Obligations with respect to such Credit Party.

“OFAC” means the U.S. Department of the Treasury’s Office of Foreign Assets Control.

“Omega Holdco” means OHI Healthcare Properties Holdco, Inc., a Delaware corporation, and its successors.

“Omega LP” means OHI Healthcare Properties Limited Partnership, a Delaware limited partnership, and its successors.

“Organization Documents” means, (a) with respect to any corporation, the certificate or articles of incorporation and the bylaws (or equivalent or comparable constitutive documents with respect to any non-U.S. jurisdiction); (b) with respect to any limited liability company, the certificate or articles of formation or organization and operating agreement; and (c) with respect to any partnership, joint venture, trust or other form of business entity, the partnership, joint venture or other applicable agreement of formation or organization and any agreement, instrument, filing or notice with respect thereto filed in connection with its formation or organization with the applicable Governmental Authority in the jurisdiction of its formation or organization and, if applicable, any certificate or articles of formation or organization of such entity.

“Outstanding Amount” means the aggregate outstanding principal amount thereof after giving effect to any Borrowings and prepayments or repayments of Term Loans, as the case may be, occurring on such date.

22

“Participant” has the meaning provided in Section 10.07(d).

“Patriot Act” means the USA Patriot Act, Pub. L. No. 107-56 et seq.

“PBGC” means the Pension Benefit Guaranty Corporation.

“Pension Plan” means any “employee pension benefit plan” (as such term is defined in Section 3(2) of ERISA), other than a Multiemployer Plan, that is subject to Title IV of ERISA and is sponsored or maintained by the Borrower or any ERISA Affiliate or to which the Borrower or any ERISA Affiliate contributes or has an obligation to contribute, or in the case of a multiple employer or other plan described in Section 4064(a) of ERISA, has made contributions at any time during the immediately preceding five plan years.

“Permitted Activity” has the meaning provided in Section 7.14.

“Permitted Liens” means, at any time, Liens in respect of the Borrower or any of its Subsidiaries permitted to exist at such time pursuant to the terms of Section 7.01.

“Person” means any natural person, corporation, limited liability company, trust, joint venture, association, company, partnership, Governmental Authority or other entity.

“Plan” means any “employee benefit plan” (as such term is defined in Section 3(3) of ERISA) established by the Borrower or, with respect to any such plan that is subject to Section 412 of the Internal Revenue Code or Title IV of ERISA, any ERISA Affiliate.

“Platform” has the meaning provided in Section 6.02.